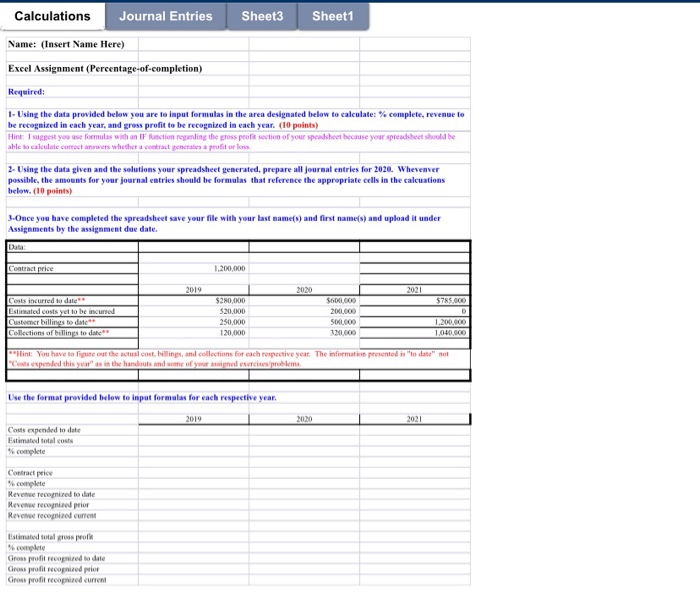

Question: Calculations Journal Entries Sheet3 Sheet1 Name: (Insert Name Here) Excel Assignment (Percentage-of-completion) Required: 1. Using the data provided below you are timpul formulas in the

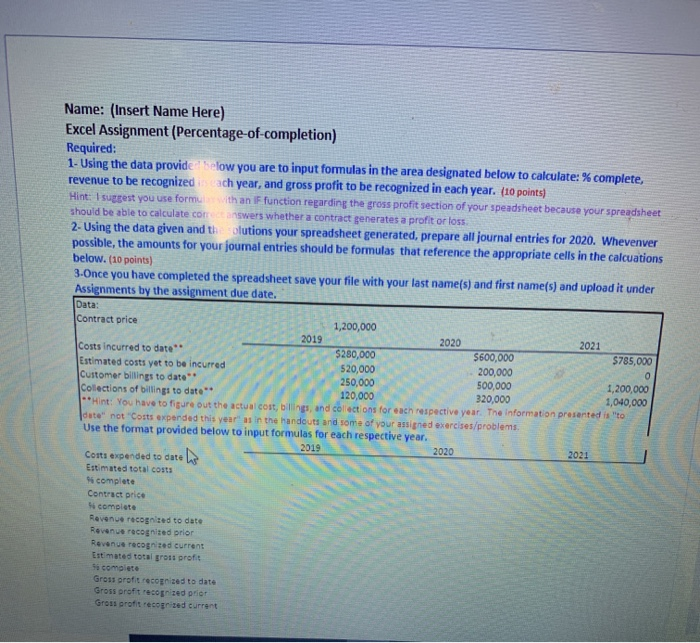

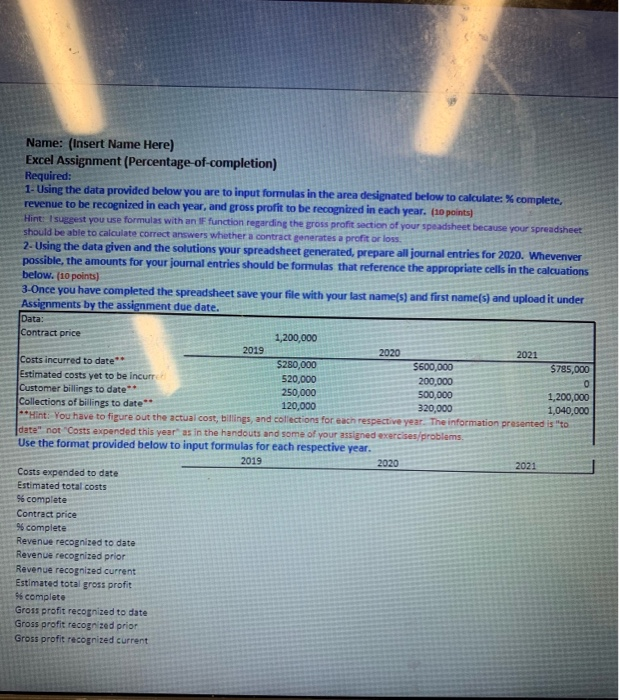

Calculations Journal Entries Sheet3 Sheet1 Name: (Insert Name Here) Excel Assignment (Percentage-of-completion) Required: 1. Using the data provided below you are timpul formulas in the area designated below to calculate: % complete, revenue to be recognized in each year, and gross profit to be recognized in each year. (10 points) Hintapety w formul a IF St anding the gross profil section of your speedsheet hecause your prehet holde we call whatsapatos 3. Using the data given and the solutions your spreadsheet generated prepare all journal entries for 2020. Wherever possible, the amounts for your journal entries should be formules that reference the appropriate cells in the calcuations below. (10 points) -Once you have completed the spreadshave your file with your last names) and first names) and upload it under Assignments by the assignment due date. I rrice 1.200,000 2019 N20 C s incurred to cart $20,000 $20.000 $60.00 2001.000 SCO Customer billings to date Collections of lines to 250.000 120.000 dat het int You have this the cost wanne and collections for each respective year. The information presented is ed me Use the format provided below to input formulas for each respective year 2019 Coutspended date Falco complete Revye Red Reviem Els Grad Grosir Name: (Insert Name Here) Excel Assignment (Percentage of completion) Required: 1. Using the data provide Selow you are to input formulas in the area designated below to calculate: % complete, revenue to be recognized ach year, and gross profit to be recognized in each year. (10 points) Hint: I suggest you use form than Ffunction regarding the gross profit section of your speadsheet because your spreadsheet should be able to calculate com answers whether a contract generates a profit or loss 2. Using the data given and tholutions your spreadsheet generated, prepare all journal entries for 2020. Whevenver possible, the amounts for your joumal entries should be formulas that reference the appropriate cells in the calcuations below. (10 points) 3-Once you have completed the spreadsheet save your file with your last name(s) and first name(s) and upload it under Assignments by the assignment due date. Data: Contract price 1,200,000 2019 2020 2021 Costs incurred to date $280,000 $600,000 $785,000 Estimated costs yet to be incurred $20,000 200,000 Customer billings to date 250,000 1,200,000 Collections of billings to date 120,000 320,000 Hint: You have to figure out the actual cost, bilings, and colectons for each respective year. The informatio oute not Costs expended this year as in the handouts and some of your assigned exercises/problems Use the format provided below to input formulas for each respective year. 2020 Corts expended to date Estimated total costs si complete Contract price i complete Revenue recognized to date Revenue recognized prior Reven t ed current Estimated total gros profit Si complete Gross profit recognised to date Gross proft recognized prior Gross profit recognized current 500,000 1,040.000 Name: (Insert Name Here) Excel Assignment (Percentage of completion) Required: 1. Using the data provided below you are to input formulas in the area designated below to calculate: % complete revenue to be recognized in each year, and gross profit to be recognized in each year. (10 points) Hintu rest you use formulas with an Function regarding the gross profit section of your speadsheet because your spreadsheet should be able to calculate correct answers whether a contract generates a profit or loss 2-Using the data given and the solutions your spreadsheet generated, prepare all journal entries for 2020. Whevenver possible, the amounts for your journal entries should be formulas that reference the appropriate cells in the calcuations below. (10 points) 3-Once you have completed the spreadsheet save your file with your fast name(s) and first names) and upload it under Assignments by the assignment due date. Data: Contract price 1,200,000 2019 2020 2021 Costs incurred to date** $280,000 S600,000 $785,000 Estimated costs yet to be incur 520,000 200,000 Customer billings to date** 250,000 500,000 1,200,000 Collections of billings to date** 120,000 320,000 1,040,000 **Hint: You have to figure out the actual cost, billings, and collections for each respective year. The information presented is to date not Costs expended this year as in the handouts and some of your assigned exercises problems Use the format provided below to input formulas for each respective year. 2019 2020 2021 Costs expended to date Estimated total costs 56 complete Contract price % complete Revenue recognized to date Revenue recognized prior Revenue recognized current Estimated total gross profit S complete Gross profit recognized to date Gross profit recognized prior Gross profit recognized current Calculations Journal Entries Sheet3 Sheet1 Name: (Insert Name Here) Excel Assignment (Percentage-of-completion) Required: 1. Using the data provided below you are timpul formulas in the area designated below to calculate: % complete, revenue to be recognized in each year, and gross profit to be recognized in each year. (10 points) Hintapety w formul a IF St anding the gross profil section of your speedsheet hecause your prehet holde we call whatsapatos 3. Using the data given and the solutions your spreadsheet generated prepare all journal entries for 2020. Wherever possible, the amounts for your journal entries should be formules that reference the appropriate cells in the calcuations below. (10 points) -Once you have completed the spreadshave your file with your last names) and first names) and upload it under Assignments by the assignment due date. I rrice 1.200,000 2019 N20 C s incurred to cart $20,000 $20.000 $60.00 2001.000 SCO Customer billings to date Collections of lines to 250.000 120.000 dat het int You have this the cost wanne and collections for each respective year. The information presented is ed me Use the format provided below to input formulas for each respective year 2019 Coutspended date Falco complete Revye Red Reviem Els Grad Grosir Name: (Insert Name Here) Excel Assignment (Percentage of completion) Required: 1. Using the data provide Selow you are to input formulas in the area designated below to calculate: % complete, revenue to be recognized ach year, and gross profit to be recognized in each year. (10 points) Hint: I suggest you use form than Ffunction regarding the gross profit section of your speadsheet because your spreadsheet should be able to calculate com answers whether a contract generates a profit or loss 2. Using the data given and tholutions your spreadsheet generated, prepare all journal entries for 2020. Whevenver possible, the amounts for your joumal entries should be formulas that reference the appropriate cells in the calcuations below. (10 points) 3-Once you have completed the spreadsheet save your file with your last name(s) and first name(s) and upload it under Assignments by the assignment due date. Data: Contract price 1,200,000 2019 2020 2021 Costs incurred to date $280,000 $600,000 $785,000 Estimated costs yet to be incurred $20,000 200,000 Customer billings to date 250,000 1,200,000 Collections of billings to date 120,000 320,000 Hint: You have to figure out the actual cost, bilings, and colectons for each respective year. The informatio oute not Costs expended this year as in the handouts and some of your assigned exercises/problems Use the format provided below to input formulas for each respective year. 2020 Corts expended to date Estimated total costs si complete Contract price i complete Revenue recognized to date Revenue recognized prior Reven t ed current Estimated total gros profit Si complete Gross profit recognised to date Gross proft recognized prior Gross profit recognized current 500,000 1,040.000 Name: (Insert Name Here) Excel Assignment (Percentage of completion) Required: 1. Using the data provided below you are to input formulas in the area designated below to calculate: % complete revenue to be recognized in each year, and gross profit to be recognized in each year. (10 points) Hintu rest you use formulas with an Function regarding the gross profit section of your speadsheet because your spreadsheet should be able to calculate correct answers whether a contract generates a profit or loss 2-Using the data given and the solutions your spreadsheet generated, prepare all journal entries for 2020. Whevenver possible, the amounts for your journal entries should be formulas that reference the appropriate cells in the calcuations below. (10 points) 3-Once you have completed the spreadsheet save your file with your fast name(s) and first names) and upload it under Assignments by the assignment due date. Data: Contract price 1,200,000 2019 2020 2021 Costs incurred to date** $280,000 S600,000 $785,000 Estimated costs yet to be incur 520,000 200,000 Customer billings to date** 250,000 500,000 1,200,000 Collections of billings to date** 120,000 320,000 1,040,000 **Hint: You have to figure out the actual cost, billings, and collections for each respective year. The information presented is to date not Costs expended this year as in the handouts and some of your assigned exercises problems Use the format provided below to input formulas for each respective year. 2019 2020 2021 Costs expended to date Estimated total costs 56 complete Contract price % complete Revenue recognized to date Revenue recognized prior Revenue recognized current Estimated total gross profit S complete Gross profit recognized to date Gross profit recognized prior Gross profit recognized current

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts