Question: Calculations needed: Calculations needed: Show what you know - due date Feb. 4 On January 1, 20x1 Prestige Corp. paid $275,000 for 12,000 shares of

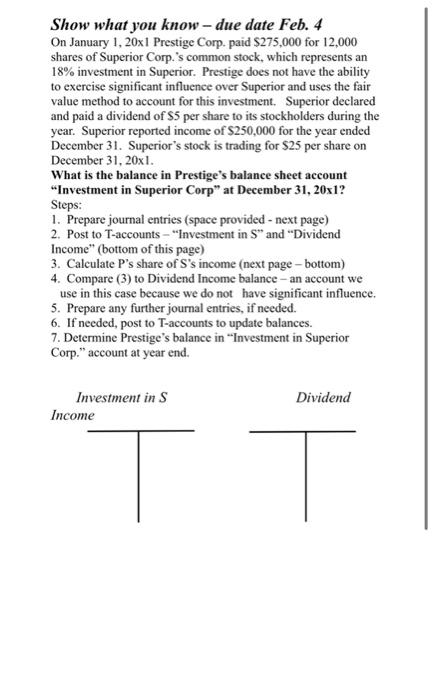

Show what you know - due date Feb. 4 On January 1, 20x1 Prestige Corp. paid $275,000 for 12,000 shares of Superior Corp.'s common stock, which represents an 18% investment in Superior. Prestige does not have the ability to exercise significant influence over Superior and uses the fair value method to account for this investment. Superior declared and paid a dividend of $5 per share to its stockholders during the year. Superior reported income of $250,000 for the year ended December 31. Superior's stock is trading for $25 per share on December 31, 20x1. What is the balance in Prestige's balance sheet account "Investment in Superior Corp" at December 31, 20x1? Steps: 1. Prepare journal entries (space provided - next page) 2. Post to T-accounts - "Investment in S" and "Dividend Income" (bottom of this page) 3. Calculate P's share of S's income (next page -bottom) 4. Compare (3) to Dividend Income balance - an account we use in this case because we do not have significant influence. 5. Prepare any further journal entries, if needed. 6. If needed, post to T-accounts to update balances. 7. Determine Prestige's balance in "Investment in Superior Corp." account at year end. Investment in s Income Dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts