Question: calculations PROBLEM 14 on January 1. a machine conting $295.000 with a 4-year life and an estimated $45.000 Salvage value was purchased. It was also

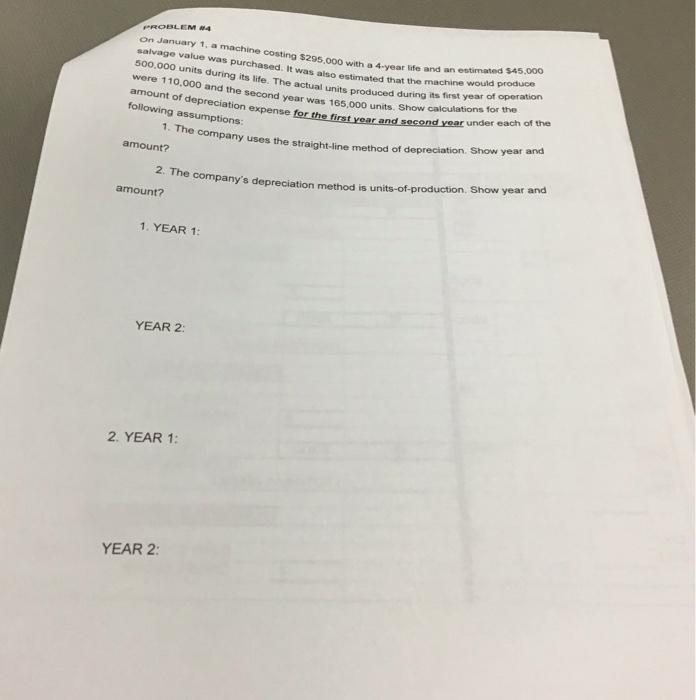

PROBLEM 14 on January 1. a machine conting $295.000 with a 4-year life and an estimated $45.000 Salvage value was purchased. It was also estimated that the machine would produce 500.000 units during its life. The actual units produced during its first year of operation were 110.000 and the second year was 165,000 units Show calculations for the amount of depreciation expense for the first year and second year under each of the following assumptions: 1. The company uses the straight-line method of depreciation Show year and amount? 2. The company's depreciation method is units-of-production, Show year and amount? 1. YEAR 1: YEAR 2 2. YEAR 1: YEAR 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts