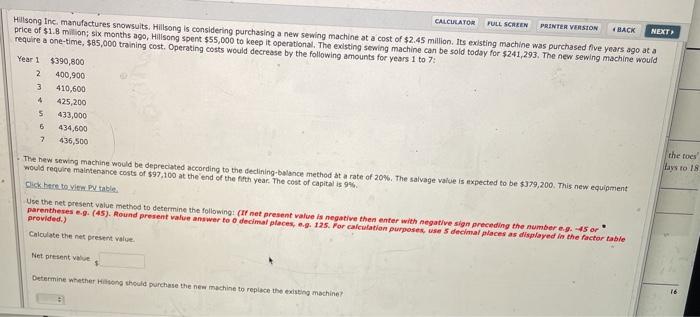

Question: CALCULATOR FULL SCREEN PAINTER VERSION HACK NEXT Hillsong Inc, manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million.

CALCULATOR FULL SCREEN PAINTER VERSION HACK NEXT Hillsong Inc, manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million six months ago, Hillsong spent $55,000 to keep it operational. The existing sewing machine can be sold today for $241,293. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $390,800 2 400,900 3 410,600 4 425,200 S 433,000 6 434,600 the toes 2 436,500 Ways to 18 The new sewing machine would be depreciated according to the declining balance method at a rate of 20%. The salvage value is expected to be $379,200. This new equipment would require maintenance costs of $97,100 at the end of the fifth year. The cost of capital is 9% Use the net present value method to determine the following: ar net present value is negative then enter with negative sin preceding the number .. 15 or parentheses . (45). Round present value answer to decimal places, s. 125. For calculation purposes se 5 decimal places as displayed in the factor table provided.) Calculate the net presente Net presenta Determine whether on the purchase the new machine to replace the existing machine? 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts