Question: CALCULATOR FULL SCREEN PRINTER VERSION BACK Cullumber Company receives $385,000 when it issues a $385,000, 8%, mortgage note payable to finance the construction of a

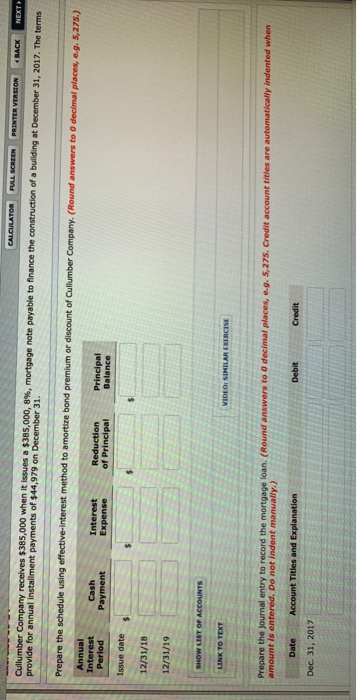

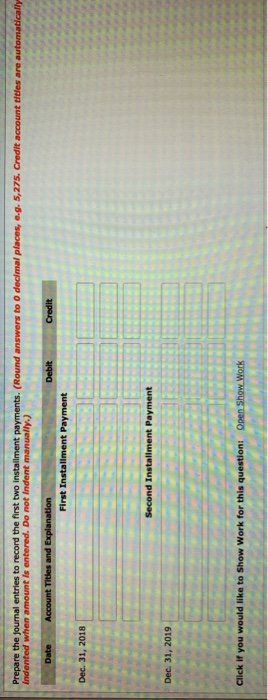

CALCULATOR FULL SCREEN PRINTER VERSION BACK Cullumber Company receives $385,000 when it issues a $385,000, 8%, mortgage note payable to finance the construction of a building at December 31, 2017. The terms provide for annual installment payments of $44,979 on December 31. Prepare the schedule using effective-interest method to amortize bond premium or discount of Cullumber Company. (Round answers to o decimal places, e.g. 5,275.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue date 12/31/18 12/31/19 VIDEO SIMILAR EXERCISE Prepare the journal entry to record the mortgage loan. (Round answers to amount is entered. Do not indent manually.) decimal places, e.g. 5,275. Credit account tities are automatically indented when Account Tities and Explanation Date Dec 31, 2017 Debit Credit Prepare the foumal entries to record the first two installment payments. (Round answers to o decimal places, e.g. 5,275. Credit account titles are automatically Indented when amount is entered. Do not Indent manually.) Debit Credit Date Account Titles and Explanation First Installment Payment Dec. 31, 2018 Dec 31, 2018 / Second Installment Payme Dec 31, 2019 Click if you would like to show Work for this questioni Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts