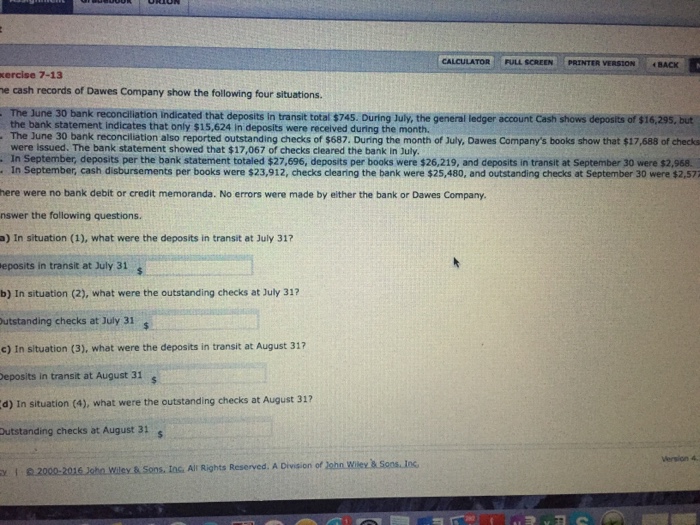

Question: CALCULATOR FULL SCREEN PRINTER VERSION BACK ercise 7-13 e cash records of Dawes Company show the following four situations. . The June 30 bank reconciliation

CALCULATOR FULL SCREEN PRINTER VERSION BACK ercise 7-13 e cash records of Dawes Company show the following four situations. . The June 30 bank reconciliation indicated the bank statement indicates that only $15,624 in deposits were recelved during the month. The June 30 bank reconciliation also reported outstanding checks of $687. During the month of July, Dawes Company's books show that $17,688 of checks were issued. The bank statement showed that $17,067 of checks cleared the bank in July In September, deposits per the bank statement totaled $27,696, deposits per books were $26,219, and deposits in transit at September 30 were $2,968. In September, cash disbursements per books were $23,912, checks clearing the bank were $25,480, and outstanding checks at September 30 were $2,57 here were no bank debit or credit memoranda. No errors were made by either the bank or Dawes Company nswer the following questions. a) In situation (1), what were the deposits in transit at July 31? eposits in transit at July 31 b) In situation (2), what were the outstanding checks at July 31? utstanding checks at July 31 s c) In situation (3), what were the deposits in transit at August 31? eposits in transit at August 31 s d) In situation (4), what were the outstanding checks at August 31? Dutstanding checks at August 31 Version 4 Inci All Rights Reserved. A Division of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts