Question: CALCULATOR FULL SCREEN PRINTER VERSION BACK IFRS 12-7 Your answer is partially correct. Try again. Kenoly Corporation owns a patent that has a carrying amount

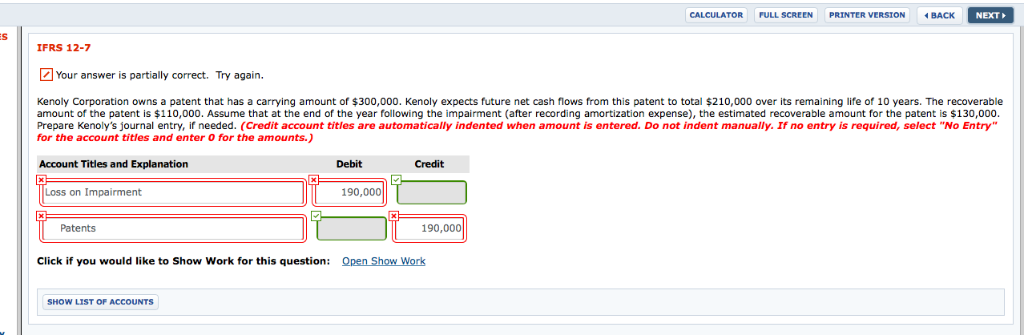

CALCULATOR FULL SCREEN PRINTER VERSION BACK IFRS 12-7 Your answer is partially correct. Try again. Kenoly Corporation owns a patent that has a carrying amount of $300,000. Kenoly expects future net cash flows from this patent to total $210,000 over its remaining life of 10 years. The recoverable amount of the patent is $110,000. Assume that at the end of the year following the impairment (after recording amortization expense), the estimated recoverable amount for the patent is $130,000 Prepare Kenoly's journal entry, if needed. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Loss on Impairment 190,000 Patents 190,000 Click if you would like to Show Work for this question: pen Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts