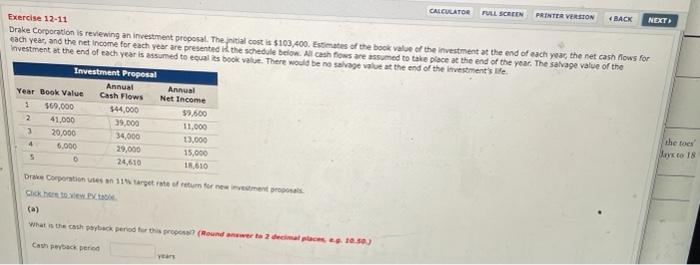

Question: CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Exercise 12-11 Drake Corporation is reviewing an investment proposal. The cost is $103,400. Estates of the book value

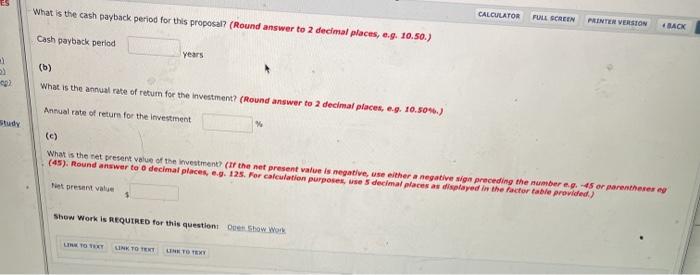

CALCULATOR FULL SCREEN PRINTER VERSION BACK NEXT Exercise 12-11 Drake Corporation is reviewing an investment proposal. The cost is $103,400. Estates of the book value of the investment at the end of each year the net cash flows for each year, and the net income for each year are presented the schedule below. Al cash flows are assumed to take place at the end of the year. The salvage value of the Investment at the end of each year is assumed to call book value. There would be no savage at the end of the investment's life Investment Proposal Annual Annual Year Book Value Cash Flows Net Income 1 569,000 $44,000 59.600 41,000 39,000 11.000 3 20,000 34,000 13,000 4 6.000 29,000 15.000 0 24.610 18.610 the to to 18 Dr Corporation en 11 target for noen Coberto What is the cashback pened to the procedere decimale 10.50 Checker ya What is the cash payback period for this proposal? (Round answer to 2 decimal places, e.g. 10.50.) CALCULATOR FULL SCREEN PRINTER VERSION BACK Cash payback period Years (6) What is the annual rate of return for the investment? (Round answer to 2 decimal places, e.g. 10.504.) Annual rate of return for the investment Study (c) What is the net present value of the investment (if the net present value is negative, use either a negative in preceding the number e. -15 or parentheses (45). Round answer to decimal places, eg. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided) ist present value Show Work Is REQUIRED for this questions Open Show Work TO THE LINK TO TENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts