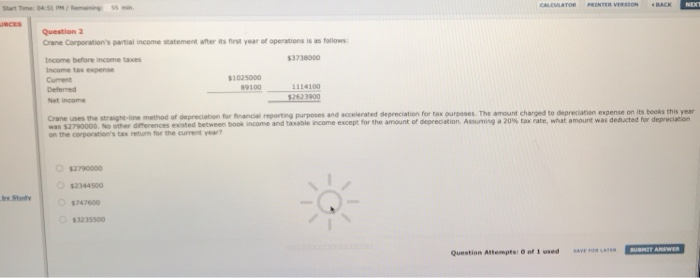

Question: CALCULATOR INTER VERSION BACK NEN JRCES Question Crane Corporation's partial income statement after its first year of operations is as follows: Income before income taxes

CALCULATOR INTER VERSION BACK NEN JRCES Question Crane Corporation's partial income statement after its first year of operations is as follows: Income before income taxes $3738000 Income tax expense Current $1095000 Deferred 89100 1114100 Net Income 52623900 Crane uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax pure the amount charged to depreciation expense on its books this year was $2790000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 20% tax rate, what amount was detected for depreciation on the corporation's tax return for the current year? $2790000 52344500 747600 2500 Question Attempts of I used SUBMIT AWER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts