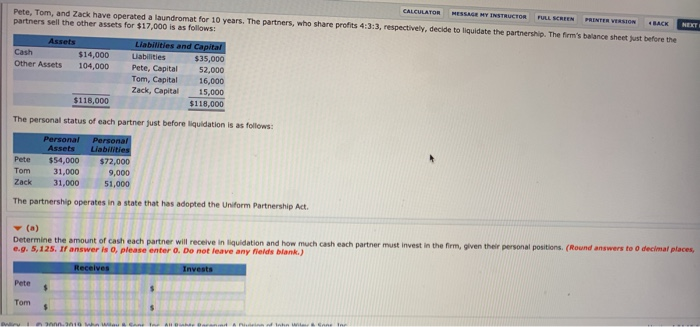

Question: CALCULATOR MESSAGE HY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK Pete, Tom, and Zack have operated a laundromat for 10 years. The partners, who share profits

CALCULATOR MESSAGE HY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK Pete, Tom, and Zack have operated a laundromat for 10 years. The partners, who share profits 4:3:3, respectively. decide to liquidate the partnership. The firm's balance sheet just before the partners sell the other assets for $17,000 is as follows: NEXT Other Assets $14,000 104,000 Uabilities and Capital abities $35,000 Pete, Capital 52,000 Tom, Capital 16,000 Zack, Capital 15,000 $118.000 $118,000 The personal status of each partner just before liquidation is as follows: Pete Tom Personal Assets $54,000 31,000 31,000 Personal abilities $72,000 9,000 51,000 Zack The partnership operates in a state that has adopted the Uniform Partnership Act, Determine the amount of cash each partner will receive in liquidation and how much cash each partner must invest in the firm, given their personal positions. (Round answers to e.g. 5,125. If answer iso, please enter O. Do not leave any fields blank.) decimal places, Invests (a) Determine the amount of cash each partner will receive in liquidation and how much cash each partner must invest in the firm, given their personal positions. e.g. 5,125. If answer is o, please enter o. Do not leave any fields blank.) Receives Invests Pete $ Tom $ Zack Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts