Question: CALCULATOR | MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION .BACX Problem 6-4A The management of Pharoah Company Is reevaluating the appropriateness of using its present

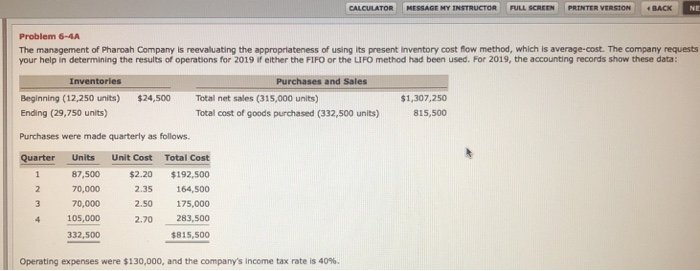

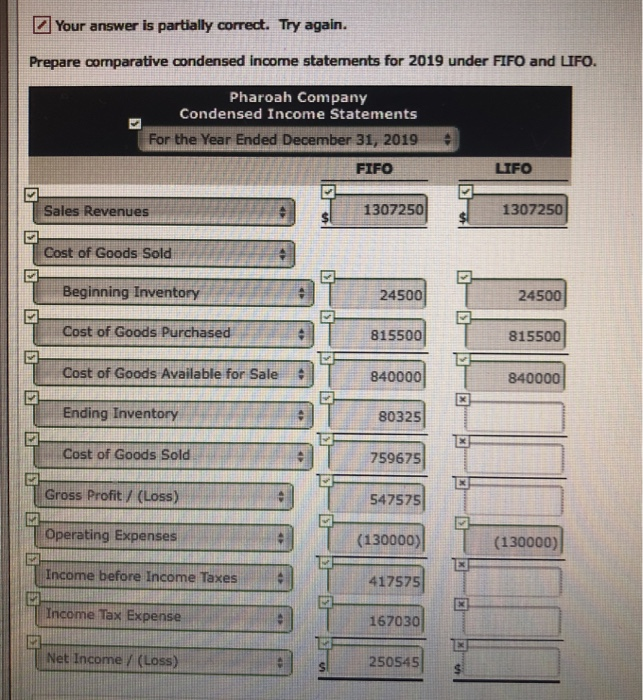

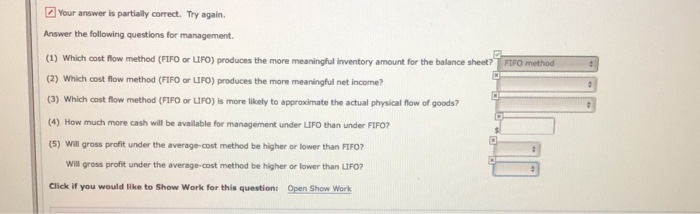

CALCULATOR | MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION .BACX Problem 6-4A The management of Pharoah Company Is reevaluating the appropriateness of using its present inventory cost flow method, which is average-cost. The company requests your help in determining the results of operations for 2019 if elther the FIFO or the LIFO method had been used. For 2019, the accounting records show these data: Inventories Purchases and Sales $1,307,250 815,500 Beginning (12,250 units) $24,500 Total net sales (315,000 units) Total cost of goods purchased (332,500 units) Ending (29,750 units) Purchases were made quarterly as follows Quarter Units Unit Cost Total Cost 87,500 2 70,000 3 70,000 4 105,000 332,500 $2.20 $192,500 2.35 164,500 2.50 175,000 2.70 283,500 815,500 | Operating expenses were $130,000, and the company's income tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts