Question: CALCULATOR PRINTER VERSION 4 BACK NEXT Exercise 21-16 Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to waterway Company. The

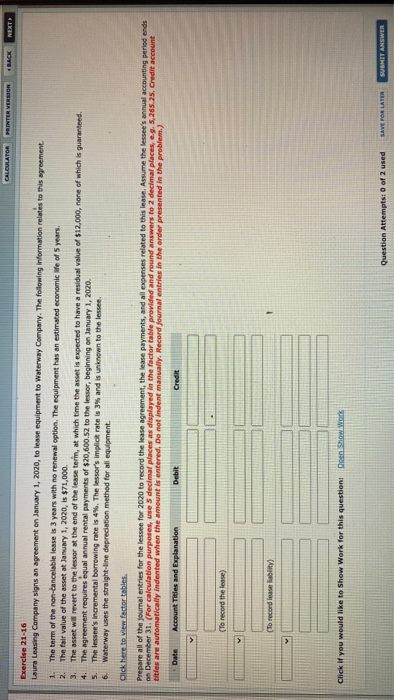

CALCULATOR PRINTER VERSION 4 BACK NEXT Exercise 21-16 Laura Leasing Company signs an agreement on January 1, 2020, to lease equipment to waterway Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic We of years. 2. The fair value of the asset at January 1, 2020, is $71,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $12,000, none of which is guaranteed. 4. The agreement requires equal annual rental payments of $20,600.52 to the lessor, beginning on January 1, 2020. The lessee's incremental borrowing rate is 4%. The lessor's implicitrate is 3% and is unknown to the lessee. Waterway uses the straight-line depreciation method for all equipment. Gick here to view factor tables Prepare all of the journal entries for the lessen for 2020 to record the lease agreement, the lease payments, and all expenses related to this lease. Assume the lessee's annual accounting period ends on December 31. (For calculation purposes, es decimal places as displayed in the factor table provided and round answers to 2 decimal places, e.g. 5,265.25. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record the lease) (To record lase abit) v Click if you would like to show Work for this question. Den Show Work Question Attempts: 0 of 2 used SAVE POR LATER SUBMIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts