Question: CALCULATOR PRINTER VERSION BACK Exercise 21A-2 a-c (Part Level Submission) On December 31, 2016, Shamrock Corporation signed a S-year, non-cancelable lease for a machine. The

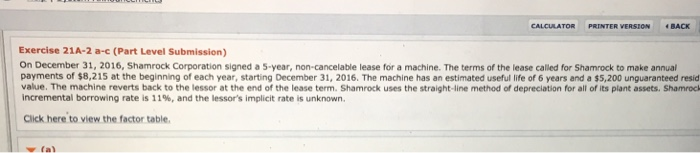

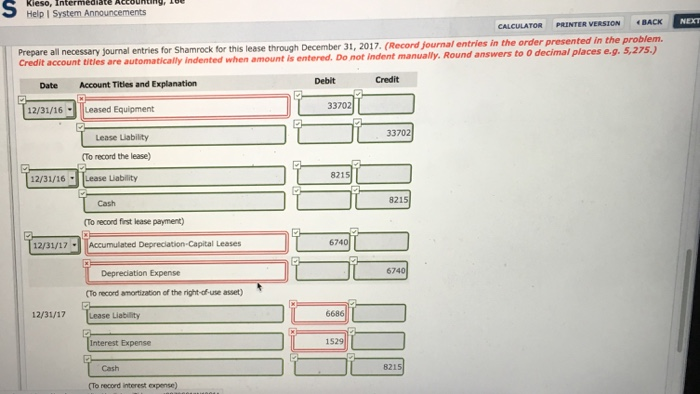

CALCULATOR PRINTER VERSION BACK Exercise 21A-2 a-c (Part Level Submission) On December 31, 2016, Shamrock Corporation signed a S-year, non-cancelable lease for a machine. The terms of the lease called for Shamrock to make annual payments of $8,215 at the beginning of each year, starting December 31, 2016. The machine has an estimated useful life of 6 years and a $5,200 unguaranteed resid value. The machine reverts back to the lessor at the end of the lease term. Shamrock uses the straight-line method of depreciation for all of its plant assets. Shamrock incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Click here to view the factor table fa)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts