Question: CALCULATOR PRINTER VERSION BACK NEX Brief Exercise 22-1 At the beginning of 2017, Oriole Construction Company changed from the completed-contract method to recognizing revenue over

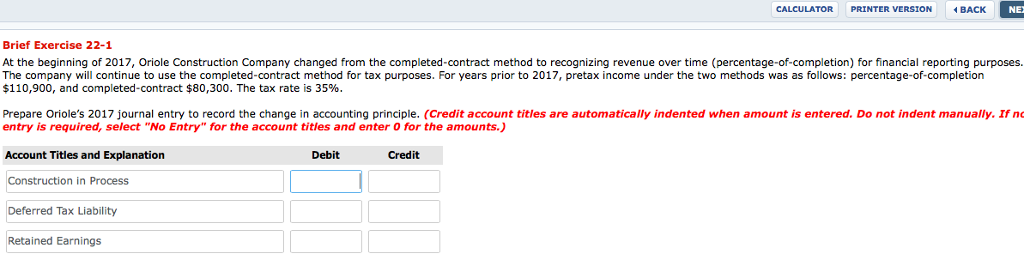

CALCULATOR PRINTER VERSION BACK NEX Brief Exercise 22-1 At the beginning of 2017, Oriole Construction Company changed from the completed-contract method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company will continue to use the completed-contract method for tax purposes. For years prior to 2017, pretax income under the two methods was as follows: percentage-of-completion $110,900, and completed-contract $80,300. The tax rate is 35%. Prepare Oriole's 2017 journal entry to record the change in accounting principle. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If nc entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Construction in Process Deferred Tax Liability Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts