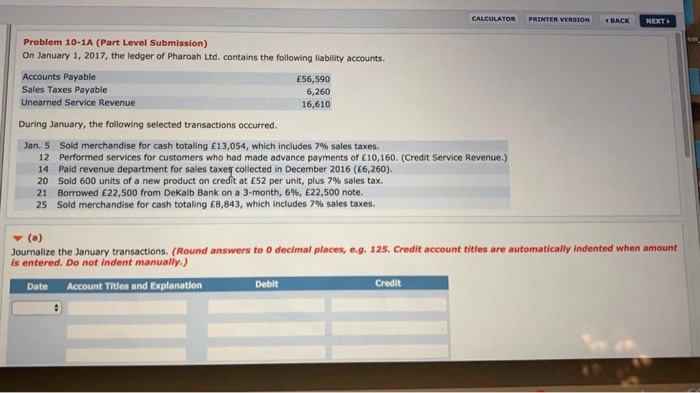

Question: CALCULATOR PRINTER VERSION BACK NEXT Problem 10-1A (Part Level Submission) On January 1, 2017, the ledger of Pharoah Ltd. contains the following liability accounts. Accounts

CALCULATOR PRINTER VERSION BACK NEXT Problem 10-1A (Part Level Submission) On January 1, 2017, the ledger of Pharoah Ltd. contains the following liability accounts. Accounts Payable E56,590 Sales Taxes Payable 6,260 Unearned Service Revenue 16,610 During January, the following selected transactions occurred. Jan. 5 Sold merchandise for cash totaling E13,054, which includes 7% sales taxes. 12 Performed services for customers who had made advance payments of 10,160. (Credit Service Revenue.) 14 Paid revenue department for sales taxes collected in December 2016 (6,260). 20 Sold 600 units of a new product on credit at E52 per unit, plus 7% sales tax. 21 Borrowed 22,500 from DeKalb Bank on a 3-month, 6%, 22,500 note. 25 Sold merchandise for cash totaling 8,843, which includes 7% sales taxes. (a) Journalize the January transactions. (Round answers to o decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts