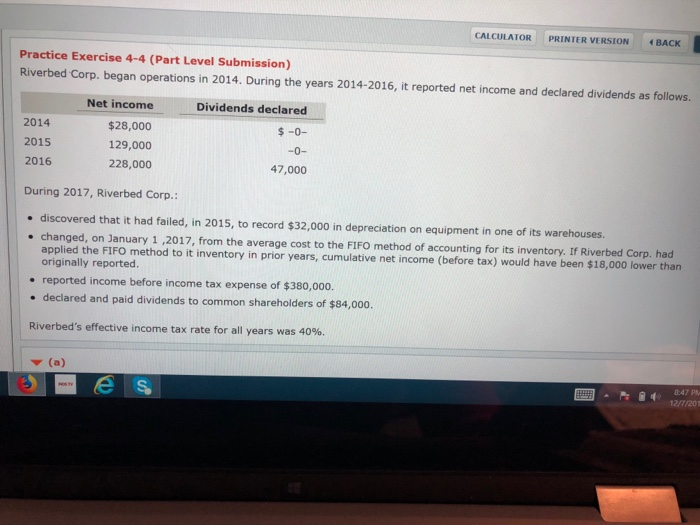

Question: CALCULATOR PRINTER VERSION BACK Practice Exercise 4-4 (Part Level Submission) Riverbed Corp. began operations in 2014. During the years 2014-2016, it reported net income and

CALCULATOR PRINTER VERSION BACK Practice Exercise 4-4 (Part Level Submission) Riverbed Corp. began operations in 2014. During the years 2014-2016, it reported net income and declared dividends as follows Net income $28,000 129,000 228,000 Dividends declared 2014 2015 2016 $-0- 47,000 During 2017, Riverbed Corp.: discovered that it had failed, in 2015, to record $32,000 in depreciation on equipment in one of its warehouses changed, on January 1 ,2017, from the average cost to the FIFO method of accounting for its inventory. If Riverbed Corp. had applied the FIFO method to it inventory in prior years, cumulative net income (before tax) would have been $18,000 lower than originally reported . reported income before income tax expense of $380,000. declared and paid dividends to common shareholders of $84,0o0. Riverbed's effective income tax rate for all years was 40%. 847 PM 12/7/201 CALCULATOR PRINTER VERSION Prepare a 2017 retained earnings statement for Riverbed Corp. (List items that increase retained earnings first.) RIVERBED CORPORATION Retained Earnings Statement CALCULATOR PRINT RIVERBED CORPORATION Retained Earnings Statement LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts