Question: CALCULATOR PRINTER VERSION BACK Problem 18-10 Your answer is partially correct. Try again. On March 1, 2017, Cheyenne Construction Company contracted to construct a factory

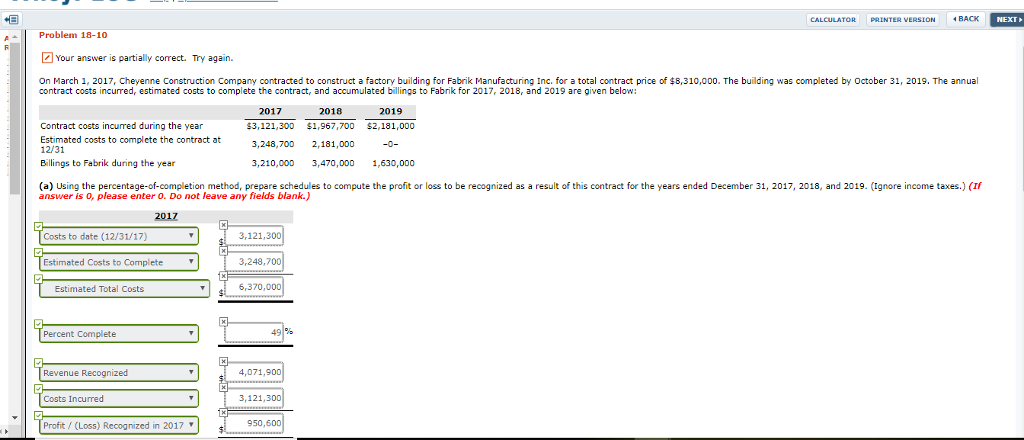

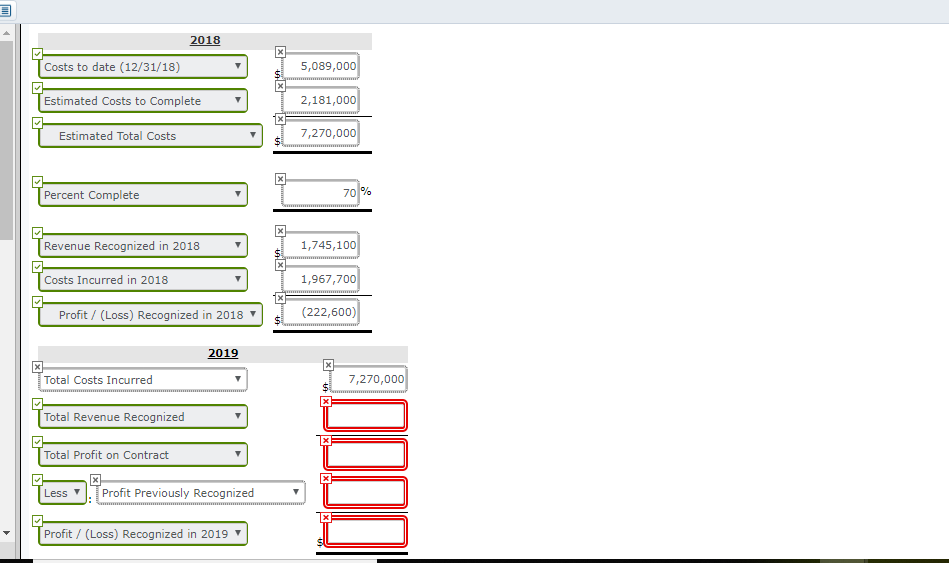

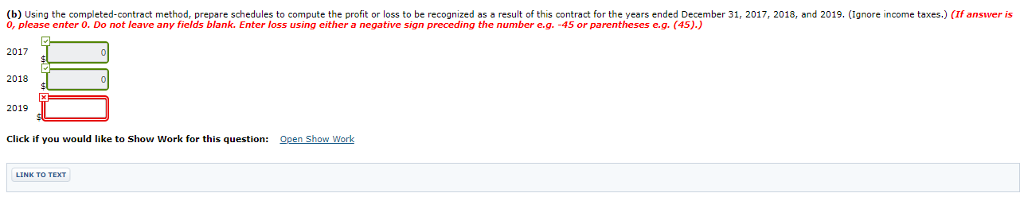

CALCULATOR PRINTER VERSION BACK Problem 18-10 Your answer is partially correct. Try again. On March 1, 2017, Cheyenne Construction Company contracted to construct a factory building for Fabrik Manufacturing Inc. for a total contract price of $8,310,000. The building was completed by October 31, 2019. The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Fabrik for 2017, 2018, and 2019 are given below 2017 2018 2019 Contract costs incurred during the year Estimated costs to complete the contract at 12/31 Billings to Fabrik during the year $3,121,300 $1,967,700 $2,181,000 3,248,700 2,181,000 -0 3,210,000 3,470,000 1,630,000 (a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2017, 2018, and 2019. (Ignore income taxes.) (If answer is o, please enter 0. Do not leave any fields blank.) 2017 3,121,300 3,248,700 6,370,000 Costs to date (12/31/17) Estimated Costs to Complete Estimated Total Costs Percent Complete 49 Revenue Recognizecd 4,071,900 Costs Incurred 3,121,300 Profit (Loss) Recognized in 2017 950,600 2018 Costs to date (12/31/18) 5,089,000 2,181,000 7,270,000 Estimated Costs to Complete Estimated Total Costs Percent Complete Revenue Recognized in 2018 1,745,100 1,967,700 (222,600) Costs Incurred in 2018 Profit/ (Loss) Recognized in 2018 Total Costs Incurred 7,270,000 Total Revenue Recognized Total Profit on Contract Less.Profit Previously Recognized Profit/ (Loss) Recognized in 2019 (b) Using the completed-contract method prepare schedules to compute the profit or loss to be recognized as a result of this contra ct for the years ended December 31,2017, 2018, and 2019. (ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank. Enter loss using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) 2017 2018 2019 Click if you would like to Show Work for this question: LINK TO TEXT CALCULATOR PRINTER VERSION BACK Problem 18-10 Your answer is partially correct. Try again. On March 1, 2017, Cheyenne Construction Company contracted to construct a factory building for Fabrik Manufacturing Inc. for a total contract price of $8,310,000. The building was completed by October 31, 2019. The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Fabrik for 2017, 2018, and 2019 are given below 2017 2018 2019 Contract costs incurred during the year Estimated costs to complete the contract at 12/31 Billings to Fabrik during the year $3,121,300 $1,967,700 $2,181,000 3,248,700 2,181,000 -0 3,210,000 3,470,000 1,630,000 (a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2017, 2018, and 2019. (Ignore income taxes.) (If answer is o, please enter 0. Do not leave any fields blank.) 2017 3,121,300 3,248,700 6,370,000 Costs to date (12/31/17) Estimated Costs to Complete Estimated Total Costs Percent Complete 49 Revenue Recognizecd 4,071,900 Costs Incurred 3,121,300 Profit (Loss) Recognized in 2017 950,600 2018 Costs to date (12/31/18) 5,089,000 2,181,000 7,270,000 Estimated Costs to Complete Estimated Total Costs Percent Complete Revenue Recognized in 2018 1,745,100 1,967,700 (222,600) Costs Incurred in 2018 Profit/ (Loss) Recognized in 2018 Total Costs Incurred 7,270,000 Total Revenue Recognized Total Profit on Contract Less.Profit Previously Recognized Profit/ (Loss) Recognized in 2019 (b) Using the completed-contract method prepare schedules to compute the profit or loss to be recognized as a result of this contra ct for the years ended December 31,2017, 2018, and 2019. (ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank. Enter loss using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) 2017 2018 2019 Click if you would like to Show Work for this question: LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts