Question: CALCULATOR PRINTER VERSION Problem 12-18 Top management of the Granger Corporation is trying to construct a performance evaluation system to use to evaluate each of

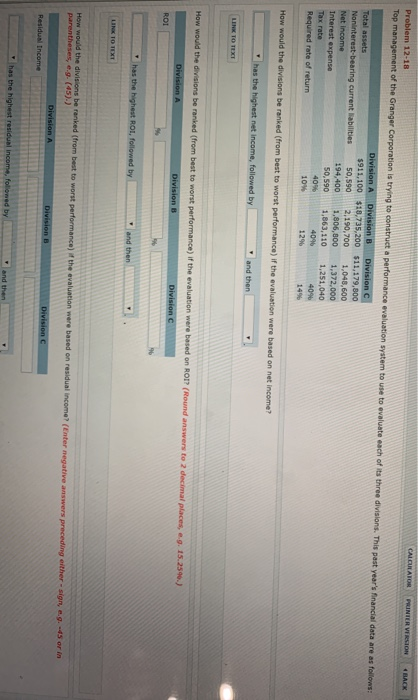

CALCULATOR PRINTER VERSION Problem 12-18 Top management of the Granger Corporation is trying to construct a performance evaluation system to use to evaluate each of its three divisions. This past year's financial data are as follows: Division A Division B Division C Total assets $911,100 $10,735,200 $11,179,800 Noninterest-bearing current abilities 50,590 2.190,700 1,048,600 Net Income 194,400 1,806,800 1,372,000 Interest expense 50,590 1,863,110 1,251,040 Tax rate 40% 40% 40% Required rate of return 10% 12% How would the divisions be ranked (from best to worst performance) if the evaluation were based on net income? has the highest net income, followed by and then How would the divisions be ranked (from best to worst performance) if the evaluation were based on ROI? (Round answers to 2 decimal places, eg15.25.) Division A Division B has the highest ROI, followed by How would the divisions be ranked (from best to worst performance) the evaluation were based on residual income (Enter negative answers preceding either - sign parentheses, e.g. (45)) 9 -5 or in Division A Residual income Division has the highest residual income, followed by and then

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts