Question: CALCULATOR STANDARD VIEW PRINTER VERSION NEXT CES Exercise 10-24 Crane Company receives $385,000 when it issues a $385,000, 796, mortgage note payable to finance the

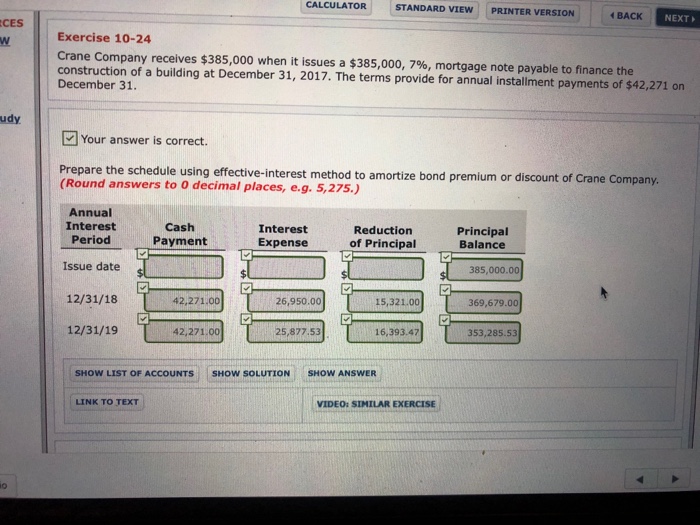

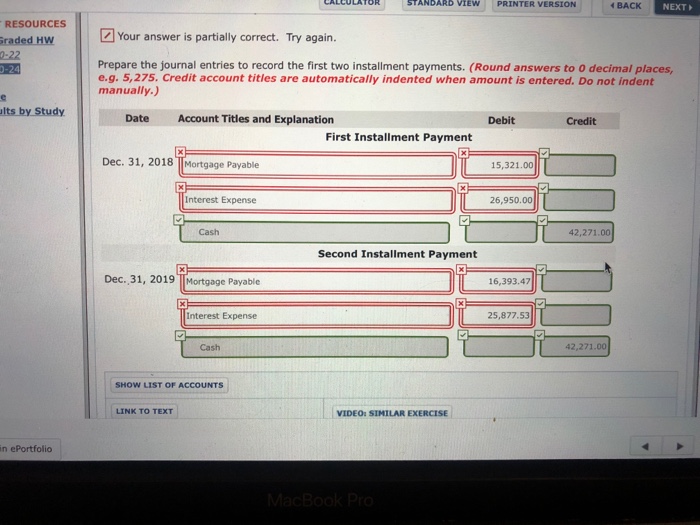

CALCULATOR STANDARD VIEW PRINTER VERSION NEXT CES Exercise 10-24 Crane Company receives $385,000 when it issues a $385,000, 796, mortgage note payable to finance the construction of a building at December 31, 2017. The terms provide for annual installment payments of $42,271 on December 31. udy Your answer is correct. Prepare the schedule using effective-interest method to amortize bond premium or discount of Crane Company. (Round answers to O decimal places, e.g. 5,275.) Annual Interest PeriodPayment Cash Reduction of Principal Principal Balance Interest Expense Issue date 385,000.00 12/31/18 42,271.00 26,950.00 15,321.00 369,679.00 12/31/19 42,271.00 25,877.53 16,393.47 353,285.53 SHOW LIST OF ACCOUNTSSHOW SOLUTIONSHOW ANSWER LINK TO TEXT VIDEO: SIMILAR EXERCISE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts