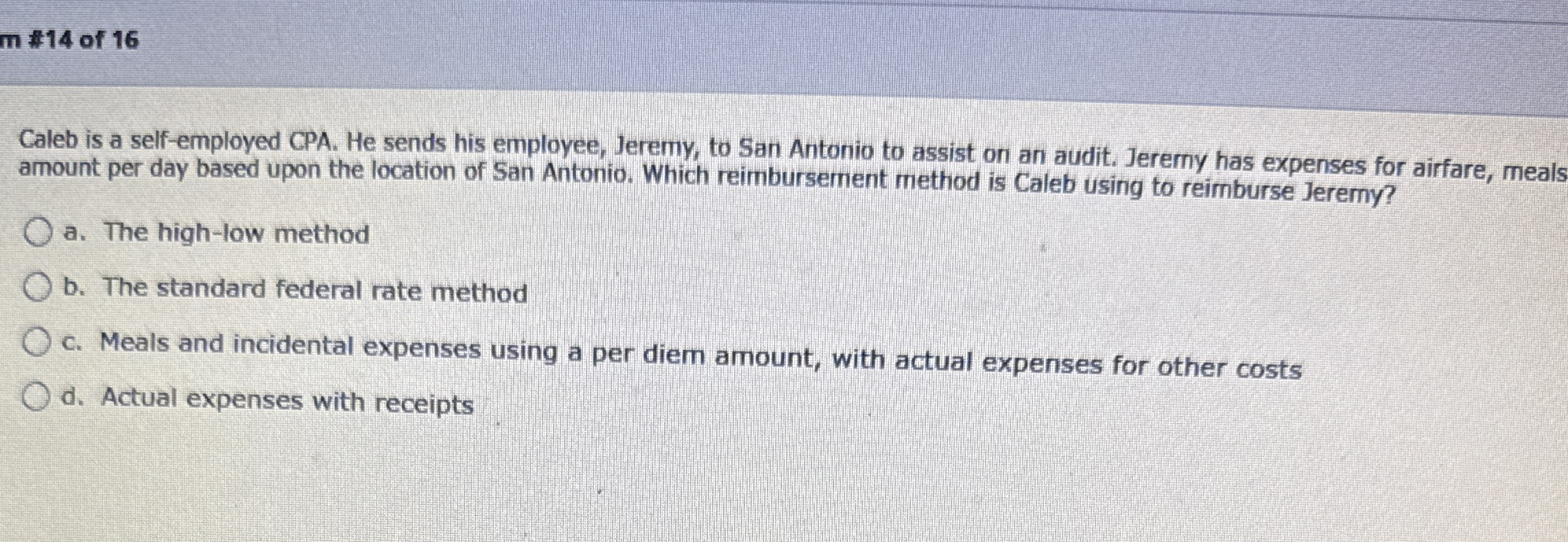

Question: Caleb is a self - employed CPA. He sends his employee, Jeremy, to San Antonio to assist on an audit. Jererny has expenses for airfare,

Caleb is a selfemployed CPA. He sends his employee, Jeremy, to San Antonio to assist on an audit. Jererny has expenses for airfare, meals

amount per day based upon the location of San Antonio. Which reimbursement method is Caleb using to reimburse Jeremy?

a The highlow method

b The standard federal rate method

c Meals and incidental expenses using a per diem amount, with actual expenses for other costs

d Actual expenses with receipts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock