Question: Calendar HW#13 Sec. 4.3 - Math 24, Spring 2020, Spring 2020 | WebAssign Five Years Ago, Diane Secured A Bank Loan Of $310,... | Chegg.com

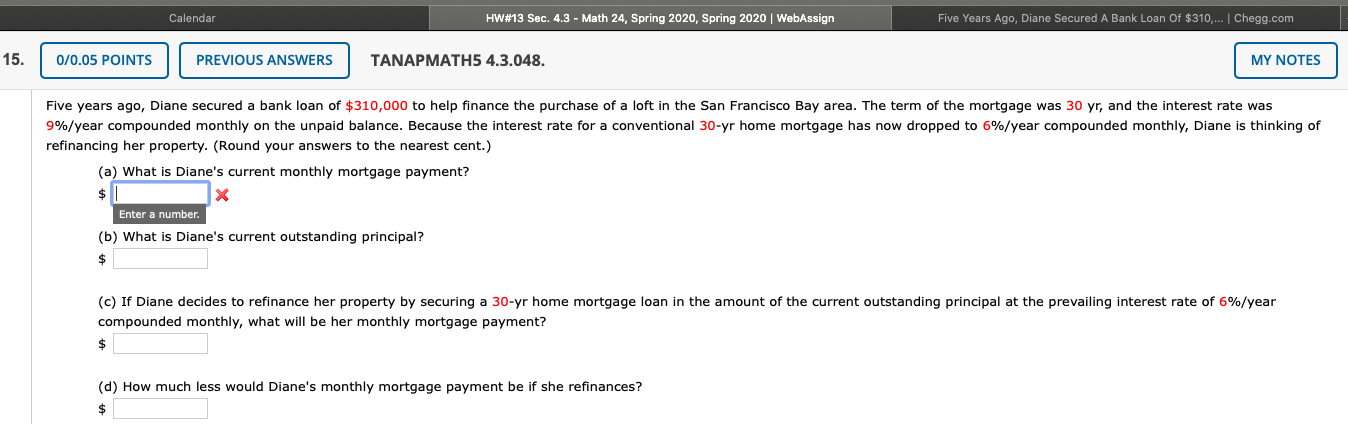

Calendar HW#13 Sec. 4.3 - Math 24, Spring 2020, Spring 2020 | WebAssign Five Years Ago, Diane Secured A Bank Loan Of $310,... | Chegg.com 15. 0/0.05 POINTS PREVIOUS ANSWERS TANAPMATH5 4.3.048. MY NOTES Five years ago, Diane secured a bank loan of $310,000 to help finance the purchase of a loft in the San Francisco Bay area. The term of the mortgage was 30 yr, and the interest rate was 9%/year compounded monthly on the unpaid balance. Because the interest rate for a conventional 30-yr home mortgage has now dropped to 6%/year compounded monthly, Diane is thinking of refinancing her property. (Round your answers to the nearest cent.) (a) What is Diane's current monthly mortgage payment? $ Enter a number (b) What is Diane's current outstanding principal? (c) If Diane decides to refinance her property by securing a 30-yr home mortgage loan in the amount of the current outstanding principal at the prevailing interest rate of 6%/year compounded monthly, what will be her monthly mortgage payment? (d) How much less would Diane's monthly mortgage payment be if she refinances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts