Question: Call and put options on the same underlying, with the maturity have the following prices: exercise price of 100 and Option Price Call 8

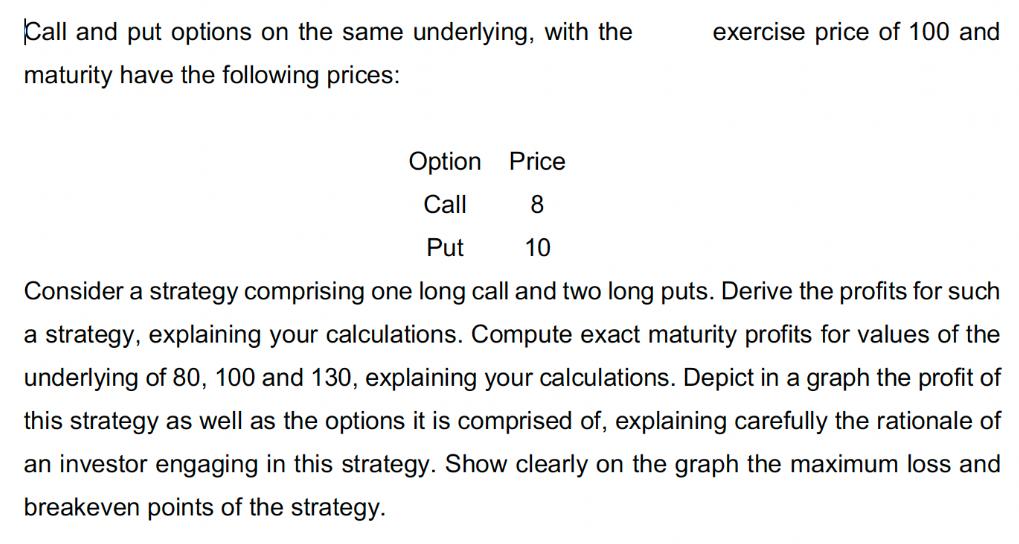

Call and put options on the same underlying, with the maturity have the following prices: exercise price of 100 and Option Price Call 8 Put 10 Consider a strategy comprising one long call and two long puts. Derive the profits for such a strategy, explaining your calculations. Compute exact maturity profits for values of the underlying of 80, 100 and 130, explaining your calculations. Depict in a graph the profit of this strategy as well as the options it is comprised of, explaining carefully the rationale of an investor engaging in this strategy. Show clearly on the graph the maximum loss and breakeven points of the strategy.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

To analyze the profits of the strategy comprising one long call and two long puts lets break down th... View full answer

Get step-by-step solutions from verified subject matter experts