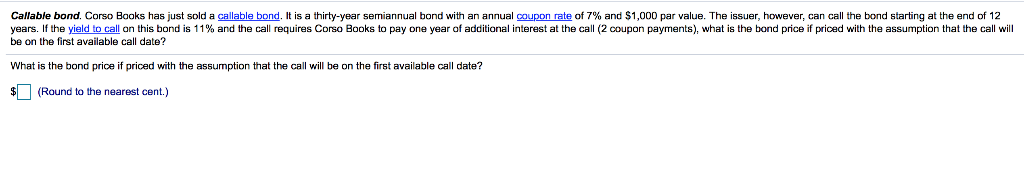

Question: Callable bond. Corso Books has ust sold a g able bond t is a thirty-year semiannual bond with an annual on ate o 7% and

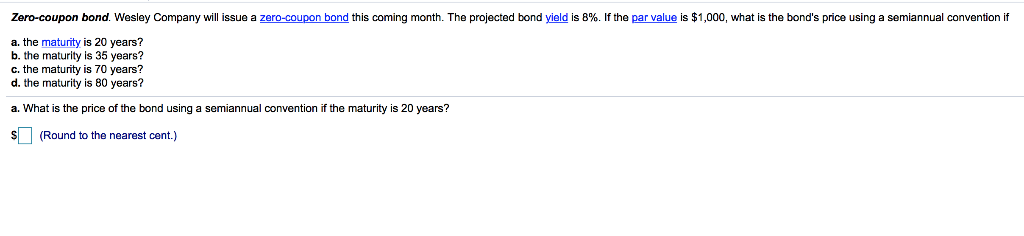

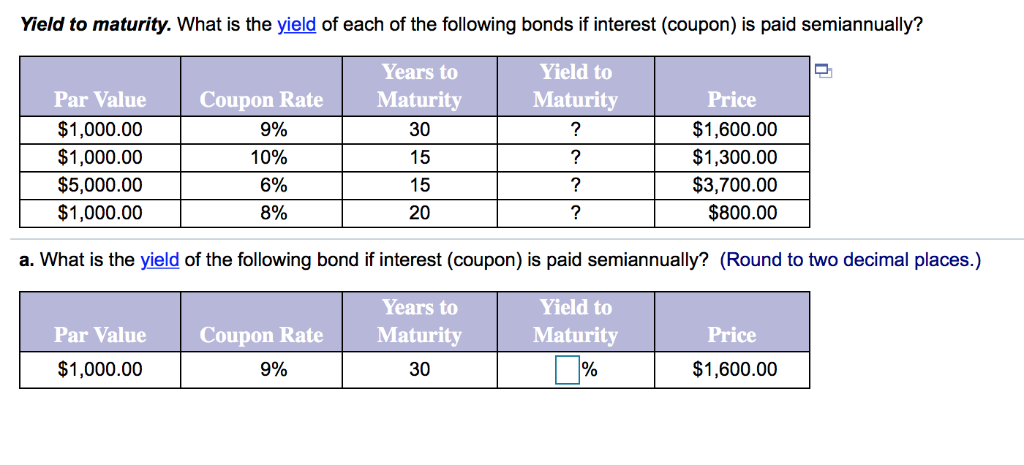

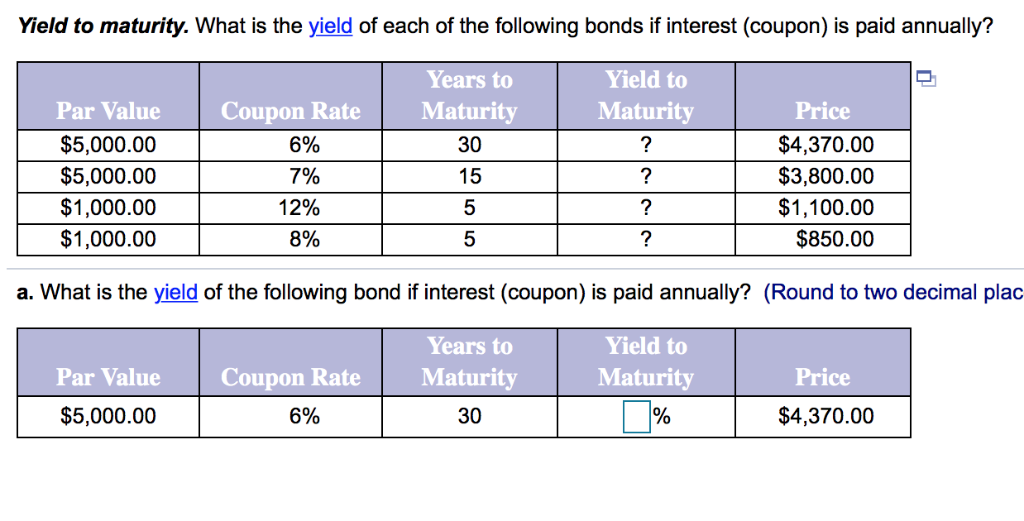

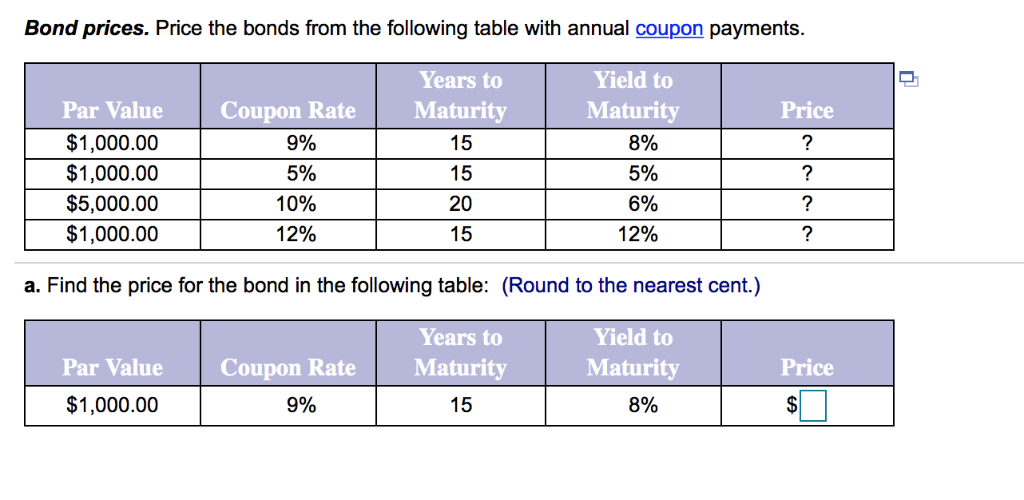

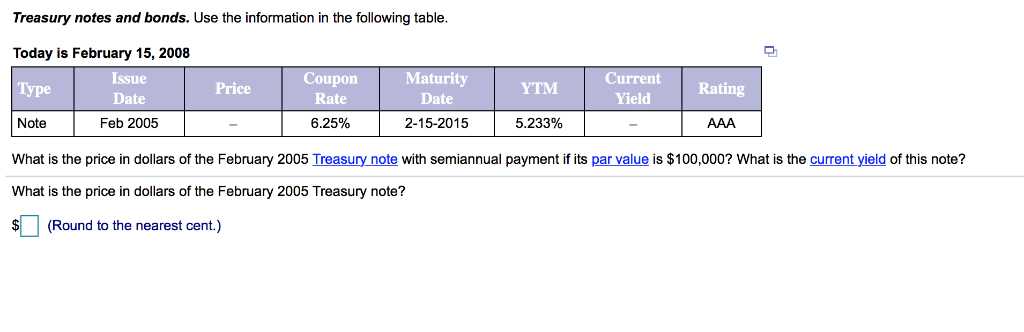

Callable bond. Corso Books has ust sold a g able bond t is a thirty-year semiannual bond with an annual on ate o 7% and $1,000 par value. The issuer, however, can call the bond starting at the end o 12 years the yield to call on this bond is 1 1 % and the cal re res Corso Books to pay one ear a additional interest at the ca 2 coupon a ment what is the bond price f priced with the assumption that Cal will be on the first available call date? What is the bond price if priced with the assumption that the call will be on the first available call date? (Round to the nearest cent) Yield to maturity. What is the yield of each of the following bonds if interest (coupon) is paid semiannually? Yield to Maturity Par Value $1,000.00 $1,000.00 $5,000.00 $1,000.00 Years to Maturity 30 15 15 20 Price $1,600.00 $1,300.00 $3,700.00 $800.00 Coupon Rate 9% 10% 5% 5% a. What is the yield of the following bond if interest (coupon) is paid semiannually? (Round to two decimal places.) Yield to Maturity Years to Price Par Value Coupon Rate Maturity $1,000.00 9% 30 $1,600.00 Bond prices. Price the bonds from the following table with annual coupon payments. Yield to Years to Maturity 15 15 20 15 Price Par Value $1,000.00 $1,000.00 $5,000.00 $1,000.00 Coupon Rate Maturit 9% 5% 10% 12% 5% 5% 6% 12% a. Find the price for the bond in the following table: (Round to the nearest cent.) Yield to Maturity Years to Price Par Value Coupon Rate Maturity $1,000.00 9% 15 5% Treasury notes and bonds. Use the information in the following table. Today is February 15, 2008 Type Issue Maturity Date 2-15-2015 Current Yield PriceCoupon YTM Rating eDatecty Feb 2005 6.25% 5.233% What is the price in dollars of the February 2005 Treasury note with semiannual payment if its par value is $100,000? What is the current yield of this note? What is the price in dollars of the February 2005 Treasury note? (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts