Question: Calling initiatiment Vitin Medical considering placing a computer system, which was purchased 2 years ago at a cost of $330,000. The system can be sold

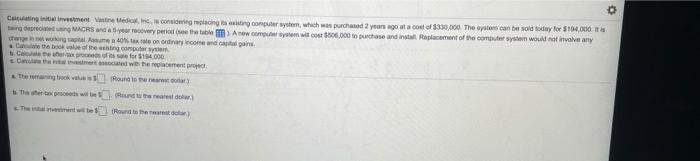

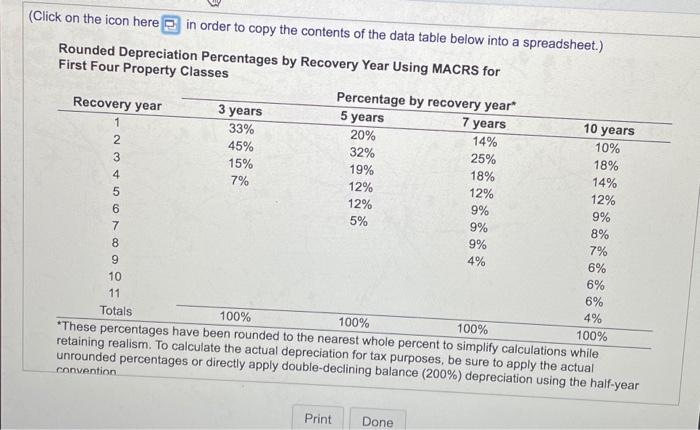

Calling initiatiment Vitin Medical considering placing a computer system, which was purchased 2 years ago at a cost of $330,000. The system can be sold today for $14.000 der MACRS das y very period the table m Arew computer system will cost $600.000 to purchase and install Replacement of the computer system would not involve any the two one on ordinaryone and catalans De bookleting computer Dere for $14.000 certet we the moment project Round to the the board will be in the earth The research 10 years 7% (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 12% 12% 12% 5 12% 9% 6 9% 5% 9% 7 9% 8 7% 4% 9 6% 10 6% 6% 11 Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention 8% 4% Print Done This Quiz: 5 pts poss Calculating initial investment Vantine Medical, Inc. is considering replacing testing computer system, which was purchased 2 years ago w acou of $30,000. They can be sold today $1.000 being deprecated using MACRS and a 5-year recovery period the title Arew computer system wilcow $500,000 to purchase and Report of computer system would come any change in net working capital. Assume a 40% tax rate on ordinary income and plans a. Calculate the book value of the existing computer system b. Calculate the after-tax proceeds of its sale for $194.000 .. Calculate the initial investment associated with the replacement project a. The remaining book value iss (Round to the nearest doftar b. The erax proceeds will be {Round to the nearest dotar) c. The initial investment will be (Round to the nearest dollar) This Quiz: 5 pts posible O Calculating initial investment Veste Medical Inc, considering replong wing computer, which was purchased 2 years pot cool 330.000. They can be dyr.00 being deprecated using MACRS and a 5-year recovery pened the new comico 08.00 to purchase and retail of the contri change in networking capital Assume a 40% tax on ordinary income and it Cate the book of the casting computer system b. Calculate the proceeds of its for $14.000 c. Calicut the investment and with replacement project a. The remaining book value is Round to the nearest dolar) The proceeds will be (Round to the rest dollar) The investment will be Round to the nearest dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts