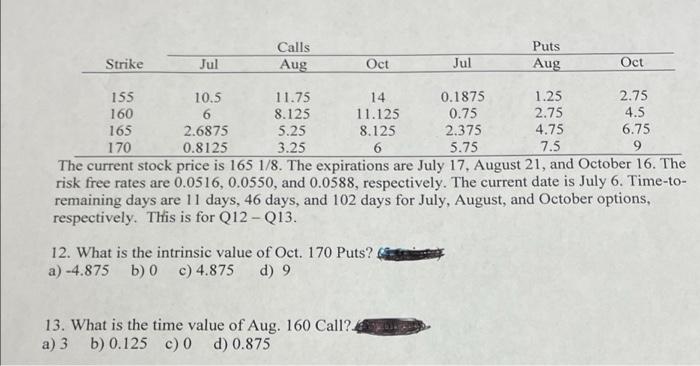

Question: Calls Aug Jul Strike Puts Aug Oct Jul Oct 155 10.5 11.75 14 0.1875 1.25 2.75 160 6 8.125 11.125 0.75 2.75 4.5 165 2.6875

Calls Aug Jul Strike Puts Aug Oct Jul Oct 155 10.5 11.75 14 0.1875 1.25 2.75 160 6 8.125 11.125 0.75 2.75 4.5 165 2.6875 5.25 8.125 2.375 4.75 6.75 170 0.8125 3.25 6 5.75 7.5 9 The current stock price is 165 1/8. The expirations are July 17, August 21, and October 16. The risk free rates are 0.0516, 0.0550, and 0.0588, respectively. The current date is July 6. Time-to- remaining days are 11 days, 46 days, and 102 days for July, August, and October options, respectively. This is for Q12-Q13. 12. What is the intrinsic value of Oct. 170 Puts? a) -4.875 b) c) 4.875 d) 9 13. What is the time value of Aug. 160 Call? a) 3 b) 0.125 c) d) 0.875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts