Question: CALO the answer a for true, b for false) 1. For most commercial banks, the biggest asset category on the balance sheet is Treasury bills

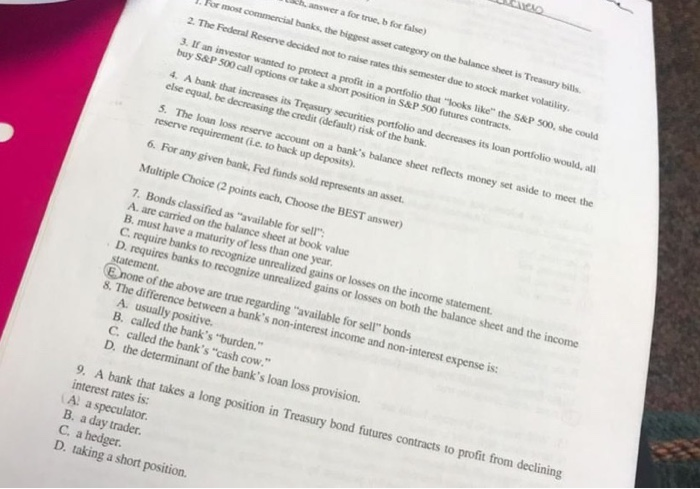

CALO the answer a for true, b for false) 1. For most commercial banks, the biggest asset category on the balance sheet is Treasury bills 2. The Federal Reserve decided not to raise rate this semester due to stock market volatility, 3. If an investor wanted to protect a profit in a portfolio that looks like the S&P 500, she could buy S&P 500 call options or take a short position in S&P 500 futures contracts. 4. A bank that increases its Treasury securities portfolio and decreases its loan portfolio would, all else equal, be decreasing the credit (default) risk of the bank. 5. The loan loss reserve account on a bank's balance sheet reflects money set aside to meet the reserve requirement (ie, to back up deposits). 6. For any given bank, Fed funds sold represents an asset Multiple Choice (2 points cach. Choose the BEST answer) 7. Bonds classified as available for sells A. are carried on the balance sheet at book value B. must have a maturity of less than one year, C. require banks to recognize unrealized gains or losses on the income statement. D. requires banks to recognize unrealized gains or losses on both the balance sheet and the income statement E none of the above are true regarding "available for sell bonds 8. The difference between a bank's non-interest income and non-interest expense is: A usually positive. B. called the bank's "burden." C. called the bank's "cash cow." D. the determinant of the bank's loan loss provision. 9. A bank that takes a long position in Treasury bond futures contracts to profit from declining interest rates is: A a speculator B. a day trader. C. a hedger D. taking a short position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts