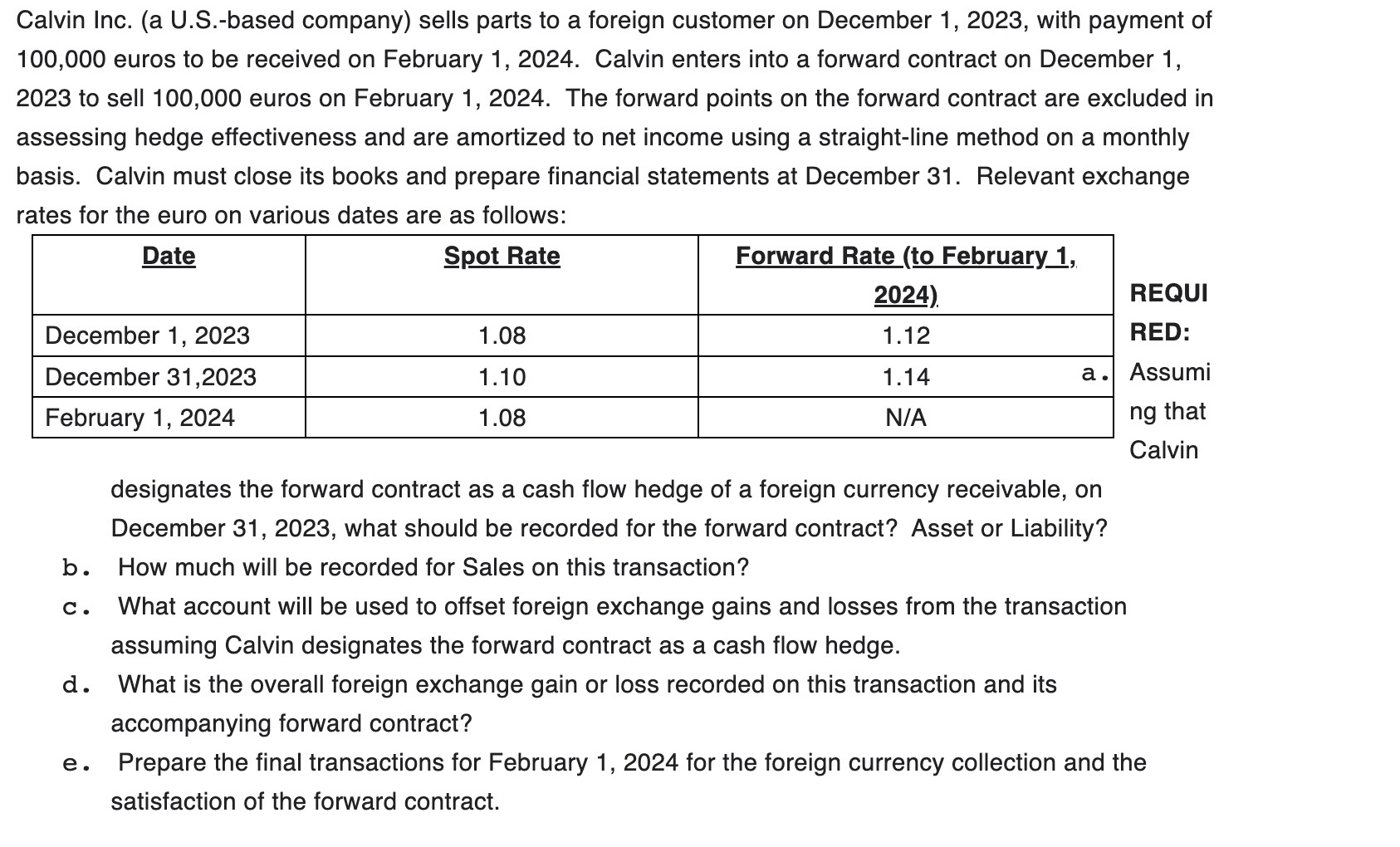

Question: Calvin Inc. ( a U . S . - based company ) sells parts t o a foreign customer o n December 1 , 2

Calvin Inc. based company sells parts a foreign customer December with payment

euros received February Calvin enters into a forward contract December

sell euros February The forward points the forward contract are excluded

assessing hedge effectiveness and are amortized net income using a straightline method a monthly

basis. Calvin must close its books and prepare financial statements December Relevant exchange

rates for the euro various dates are follows:

REQUI

RED:

Assumi

that

Calvin

designates the forward contract a cash flow hedge a foreign currency receivable,

December what should recorded for the forward contract? Asset Liability?

How much will recorded for Sales this transaction?

What account will used offset foreign exchange gains and losses from the transaction

assuming Calvin designates the forward contract a cash flow hedge.

What the overall foreign exchange gain loss recorded this transaction and its

accompanying forward contract?

Prepare the final transactions for February for the foreign currency collection and the

satisfaction the forward contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock