Question: CAMP model related question, please help with question 3, thanks a lot Security B has a price of P=10 and a beta of =0.5. The

CAMP model related question, please help with question 3, thanks a lot

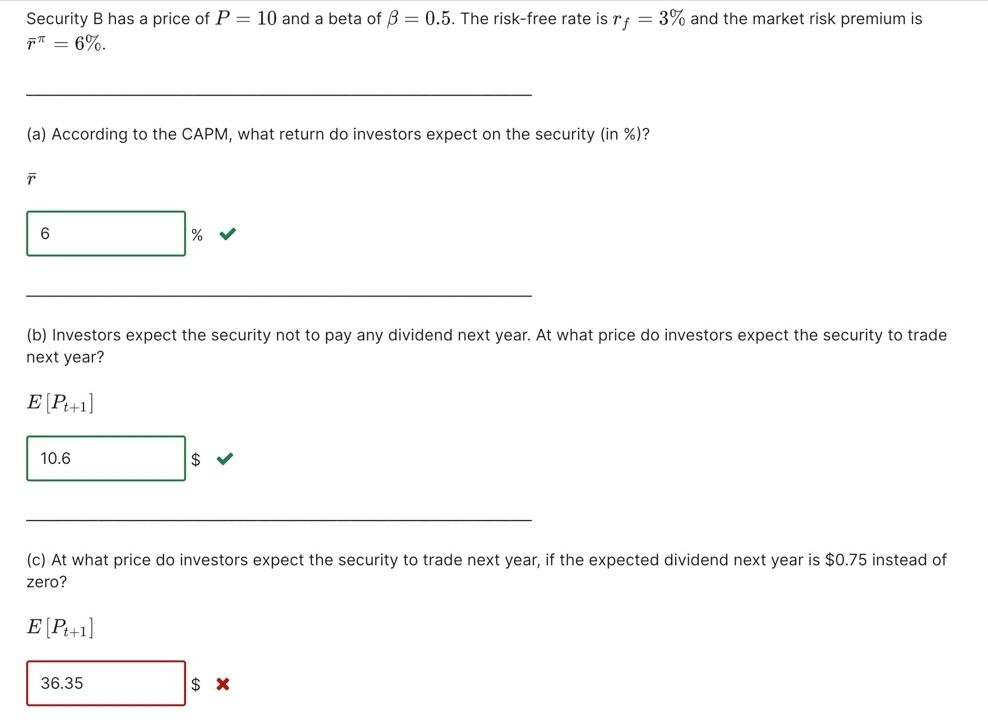

Security B has a price of P=10 and a beta of =0.5. The risk-free rate is rf=3% and the market risk premium is r=6% (a) According to the CAPM, what return do investors expect on the security (in \%)? % (b) Investors expect the security not to pay any dividend next year. At what price do investors expect the security to trade next year? E[Pt+1] (c) At what price do investors expect the security to trade next year, if the expected dividend next year is $0.75 instead of zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts