Question: Can a tutor guide me with this question? Question 5 (7 marks) During the class lecture (long shot bias) I mentioned that IPOs have relatively

Can a tutor guide me with this question?

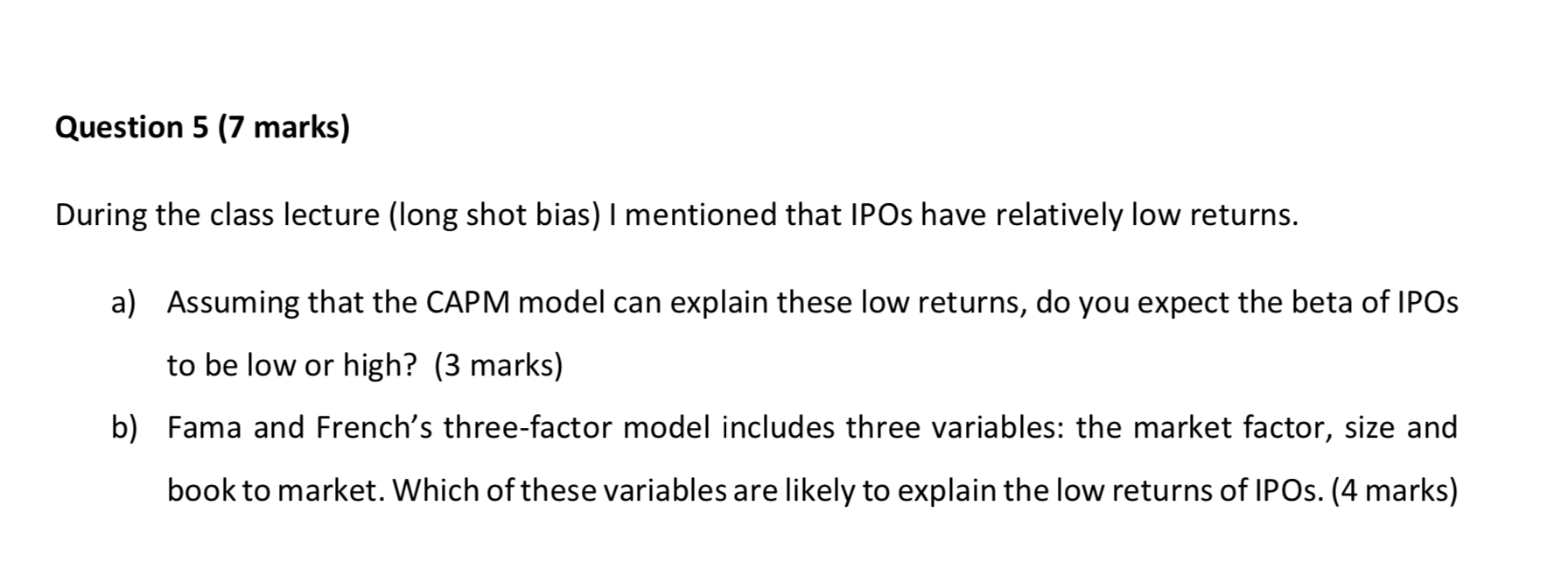

Question 5 (7 marks) During the class lecture (long shot bias) I mentioned that IPOs have relatively low returns. 3) Assuming that the CAPM model can explain these low returns, do you expect the beta of IPOs to be low or high? (3 marks) b) Fama and French's three-factor model includes three variables: the market factor, size and book to market. Which of these variables are likely to explain the low returns of IPOs. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts