Question: Can also help with balance sheet, income statement, and retained earnings Transactions for Wonderland 1. Feb. 1 Alice decided to start a business. She wanted

Can also help with balance sheet, income statement, and retained earnings

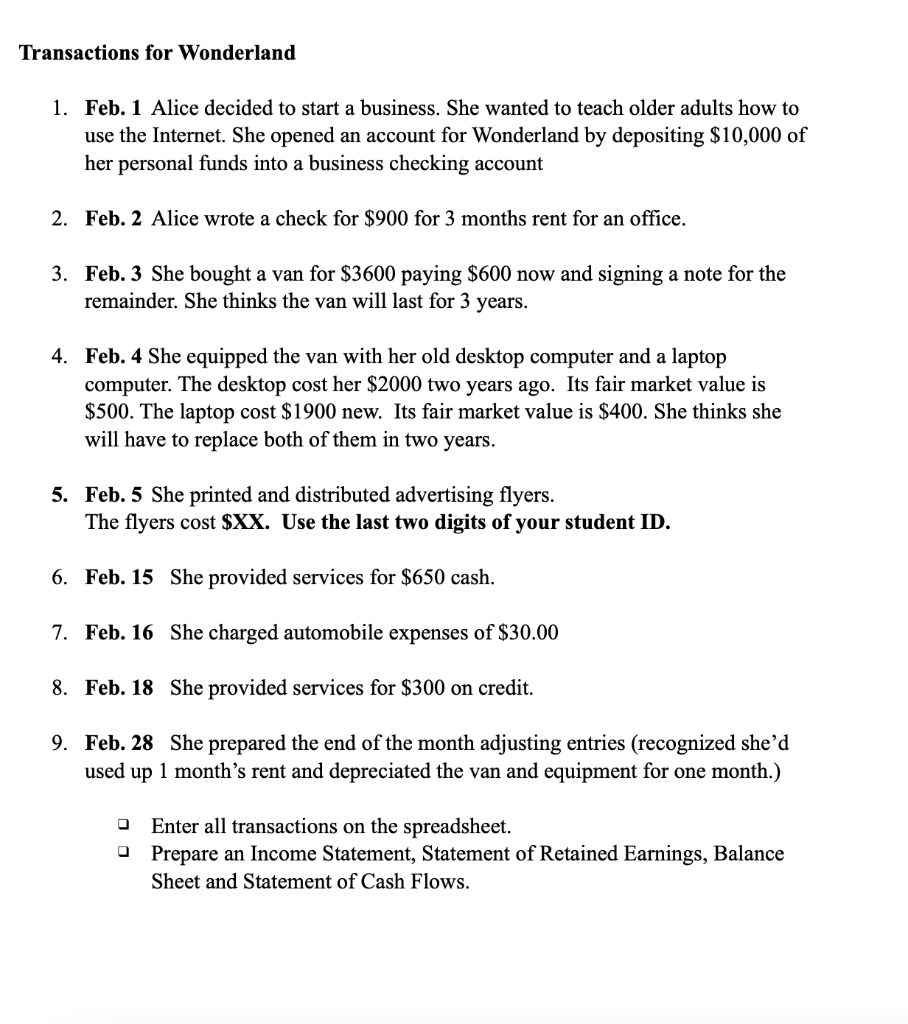

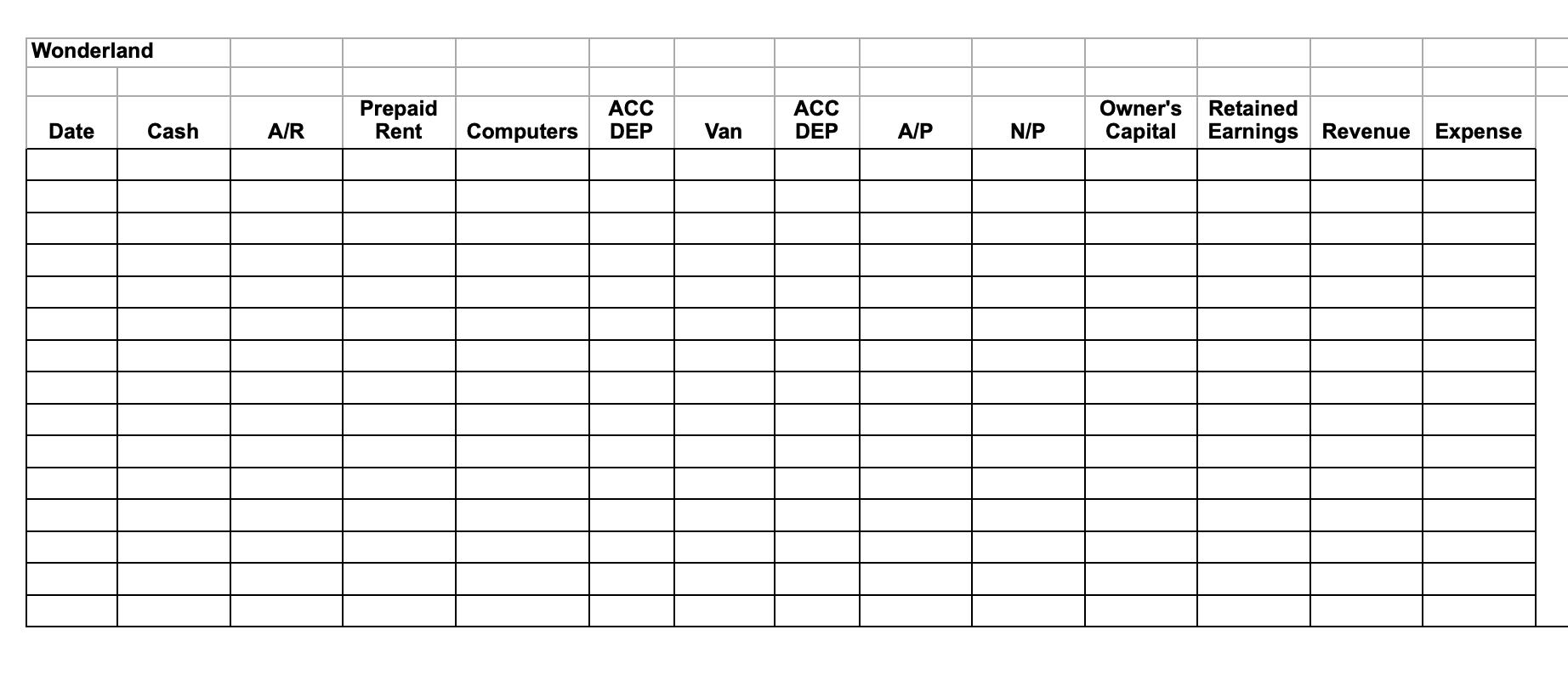

Transactions for Wonderland 1. Feb. 1 Alice decided to start a business. She wanted to teach older adults how to use the Internet. She opened an account for Wonderland by depositing $10,000 of her personal funds into a business checking account 2. Feb. 2 Alice wrote a check for $900 for 3 months rent for an office. 3. Feb. 3 She bought a van for $3600 paying $600 now and signing a note for the remainder. She thinks the van will last for 3 years. 4. Feb. 4 She equipped the van with her old desktop computer and a laptop computer. The desktop cost her $2000 two years ago. Its fair market value is $500. The laptop cost $1900 new. Its fair market value is $400. She thinks she will have to replace both of them in two years. 5. Feb. 5 She printed and distributed advertising flyers. The flyers cost $XX. Use the last two digits of your student ID. 6. Feb. 15 She provided services for $650 cash. 7. Feb. 16 She charged automobile expenses of $30.00 8. Feb. 18 She provided services for $300 on credit. 9. Feb. 28 She prepared the end of the month adjusting entries (recognized she'd used up 1 month's rent and depreciated the van and equipment for one month.) a Enter all transactions on the spreadsheet. - Prepare an Income Statement, Statement of Retained Earnings, Balance Sheet and Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts