Question: can an expert answer 2 and 3 a and b for me please?! id love to give an upvote! 2) You are buying a house

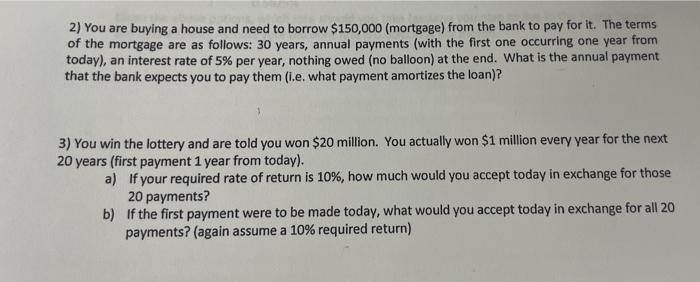

2) You are buying a house and need to borrow $150,000 (mortgage) from the bank to pay for it. The terms of the mortgage are as follows: 30 years, annual payments (with the first one occurring one year from today), an interest rate of 5% per year, nothing owed (no balloon) at the end. What is the annual payment that the bank expects you to pay them (i.e. what payment amortizes the loan)? 3) You win the lottery and are told you won $20 million. You actually won $1 million every year for the next 20 years (first payment 1 year from today). a) If your required rate of return is 10%, how much would you accept today in exchange for those 20 payments? b) If the first payment were to be made today, what would you accept today in exchange for all 20 payments? (again assume a 10% required return)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts