Question: Can an expert please solve this. Exercise 8-24 (Algorithmic) (LO. 2) Andre acquired a computer on March 3, 2018, for $33,400. He elects the straight-line

Can an expert please solve this.

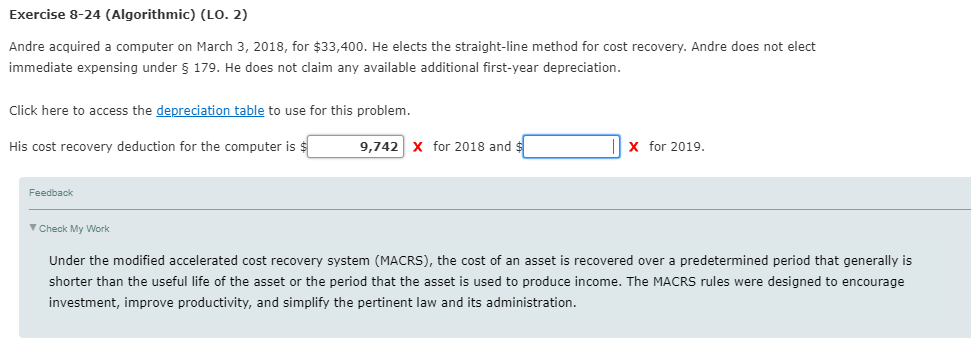

Exercise 8-24 (Algorithmic) (LO. 2) Andre acquired a computer on March 3, 2018, for $33,400. He elects the straight-line method for cost recovery. Andre does not elect immediate expensing under $ 179. He does not claim any available additional first-year depreciation. Click here to access the depreciation table to use for this problem. His cost recovery deduction for the computer is 9,742 X for 2018 and X for 2019 Feedback Check My Work Under the modified accelerated cost recovery system (MACRS), the cost of an asset is recovered over a predetermined period that generally is shorter than the useful life of the asset or the period that the asset is used to produce income. The MACRS rules were designed to encourage investment, improve productivity, and simplify the pertinent law and its administration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts