Question: can any one help me this question with out excel and can explain how to please. 09.05-PRO03 A virtual mold apparatus for producing dental crowns

can any one help me this question with out excel and can explain how to please.

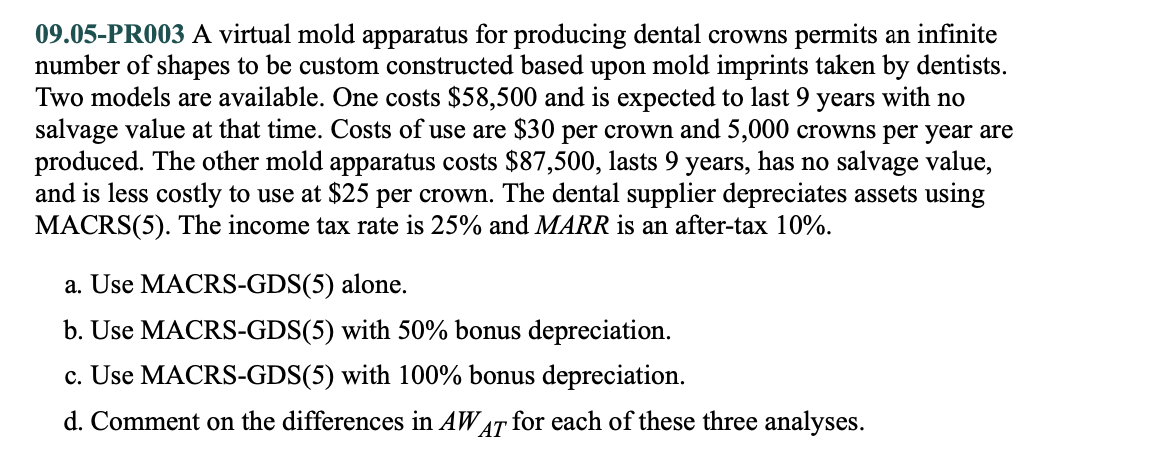

09.05-PRO03 A virtual mold apparatus for producing dental crowns permits an infinite number of shapes to be custom constructed based upon mold imprints taken by dentists. Two models are available. One costs $58,500 and is expected to last 9 years with no salvage value at that time. Costs of use are $30 per crown and 5,000 crowns per year are produced. The other mold apparatus costs $87,500, lasts 9 years, has no salvage value, and is less costly to use at $25 per crown. The dental supplier depreciates assets using MACRS(5). The income tax rate is 25% and MARR is an after-tax 10%. a. Use MACRS-GDS(5) alone. b. Use MACRS-GDS(5) with 50% bonus depreciation. c. Use MACRS-GDS(5) with 100% bonus depreciation. d. Comment on the differences in AW AT for each of these three analyses. 09.05-PRO03 A virtual mold apparatus for producing dental crowns permits an infinite number of shapes to be custom constructed based upon mold imprints taken by dentists. Two models are available. One costs $58,500 and is expected to last 9 years with no salvage value at that time. Costs of use are $30 per crown and 5,000 crowns per year are produced. The other mold apparatus costs $87,500, lasts 9 years, has no salvage value, and is less costly to use at $25 per crown. The dental supplier depreciates assets using MACRS(5). The income tax rate is 25% and MARR is an after-tax 10%. a. Use MACRS-GDS(5) alone. b. Use MACRS-GDS(5) with 50% bonus depreciation. c. Use MACRS-GDS(5) with 100% bonus depreciation. d. Comment on the differences in AW AT for each of these three analyses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts