Question: can any one solve this question best regards uated from MBA program with finance major. Immediately after graduation you Q2: You have just graduated from

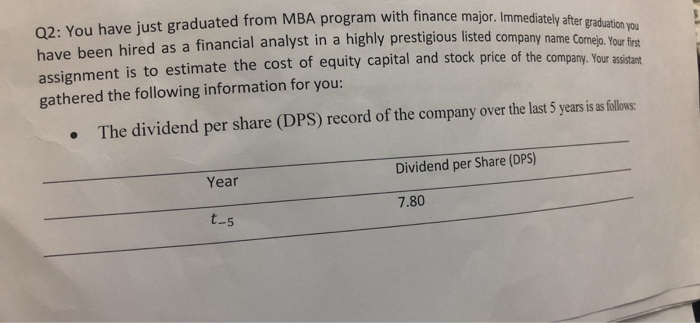

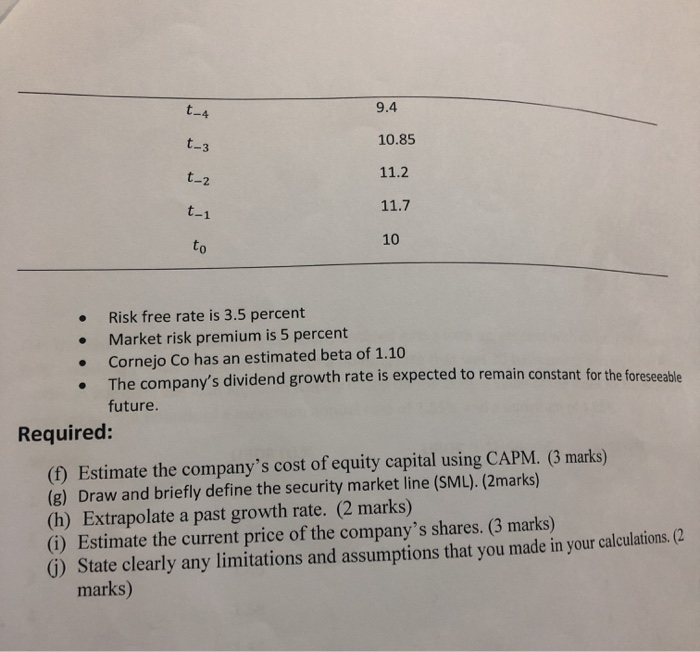

uated from MBA program with finance major. Immediately after graduation you Q2: You have just graduated from MBA program with finance have been hired as a financial analyst in a highly prestigious listed assignment is to estimate the cost of equity capital and stock price of the company. Your as gathered the following information for you: The dividend per share (DPS) record of the company over the last 5 years is as follows: Dividend per Share (DPS) Year 7.80 t_5 9.4 10.85 11.2 11.7 Risk free rate is 3.5 percent Market risk premium is 5 percent Cornejo Co has an estimated beta of 1.10 The company's dividend growth rate is expected to remain constant for the foresee future. Required: (f) Estimate the company's cost of equity capital using CAPM. (3 marks) (g) Draw and briefly define the security market line (SML). (2marks) (h) Extrapolate a past growth rate. (2 marks) (i) Estimate the current price of the company's shares. (3 marks) (1) State clearly any limitations and assumptions that you made in your calculations. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts