Question: Can anybody please solve this as soon as possible. On January 1, 2022, Antarctic Air Inc. enters a seven-year, non-cancellable lease agreement to lease an

Can anybody please solve this as soon as possible.

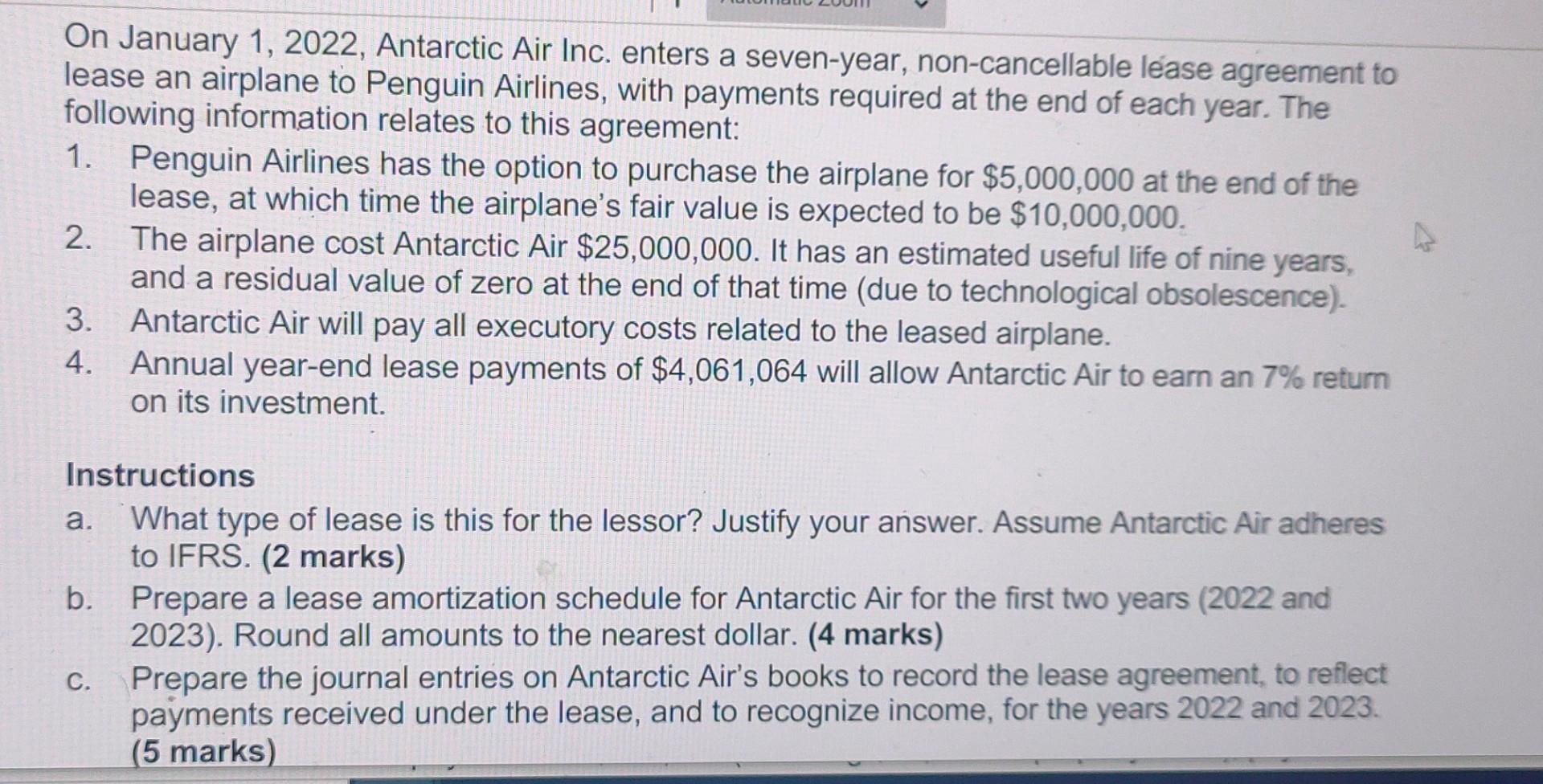

On January 1, 2022, Antarctic Air Inc. enters a seven-year, non-cancellable lease agreement to lease an airplane to Penguin Airlines, with payments required at the end of each year. The following information relates to this agreement: 1. Penguin Airlines has the option to purchase the airplane for $5,000,000 at the end of the lease, at which time the airplane's fair value is expected to be $10,000,000. A 2. The airplane cost Antarctic Air $25,000,000. It has an estimated useful life of nine years, and a residual value of zero at the end of that time (due to technological obsolescence). 3. Antarctic Air will pay all executory costs related to the leased airplane. 4. Annual year-end lease payments of $4,061,064 will allow Antarctic Air to earn an 7% return on its investment. Instructions a. What type of lease is this for the lessor? Justify your answer. Assume Antarctic Air adheres to IFRS. (2 marks) b. Prepare a lease amortization schedule for Antarctic Air for the first two years (2022 and 2023). Round all amounts to the nearest dollar. (4 marks) c. Prepare the journal entries on Antarctic Air's books to record the lease agreement, to reflect payments received under the lease, and to recognize income, for the years 2022 and 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts