Question: can Anyone Answer these three , much appreciable if someone send me correct answers Given the following data for a stock: beta =1.5; risk-tree rate

can Anyone Answer these three , much appreciable if someone send me correct answers

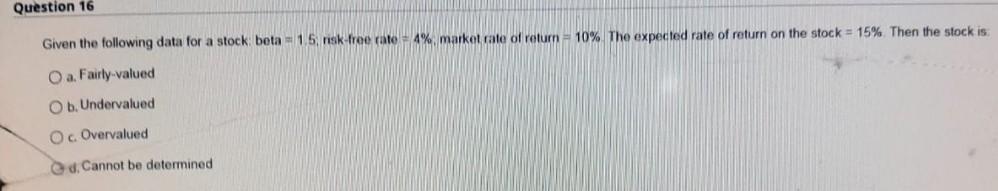

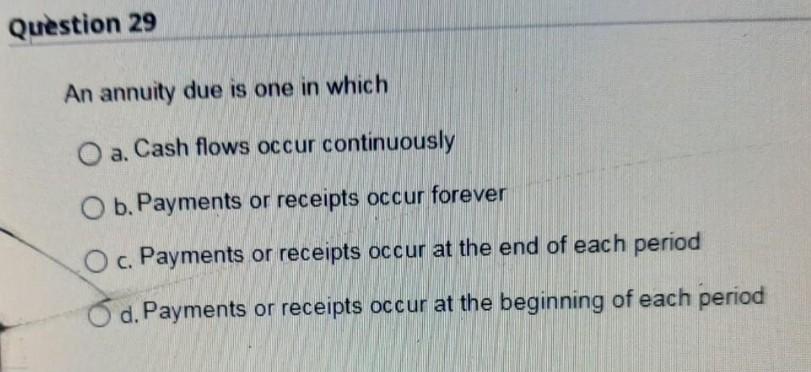

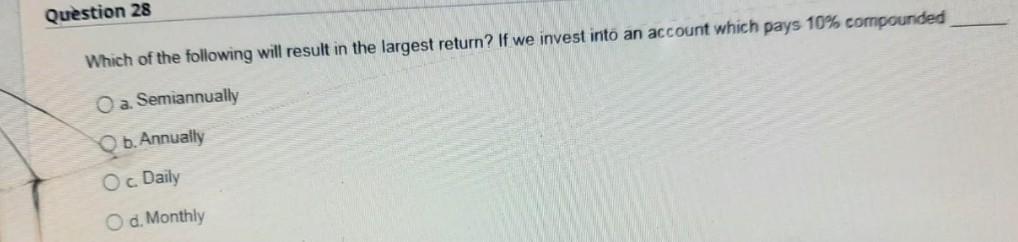

Given the following data for a stock: beta =1.5; risk-tree rate =4%, market rate of return =10%. The expected rate of return on the stock =15%. Then the stock is a. Fairly-valued b. Undervalued c. Overvalued d. Cannot be determined An annuity due is one in which a. Cash flows occur continuously b. Payments or receipts occur forever c. Payments or receipts occur at the end of each period d. Payments or receipts occur at the beginning of each period Which of the following will result in the largest return? If we invest into an account which pays 10% compounded a. Semiannually b. Annuaily c. Daily d. Monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts