Question: Can anyone assist me in this excel problem for math My income is 1163.00 a month. Following Directions is the beginning of the questions Thanks

Can anyone assist me in this excel problem for math My income is 1163.00 a month. Following Directions is the beginning of the questions

Thanks

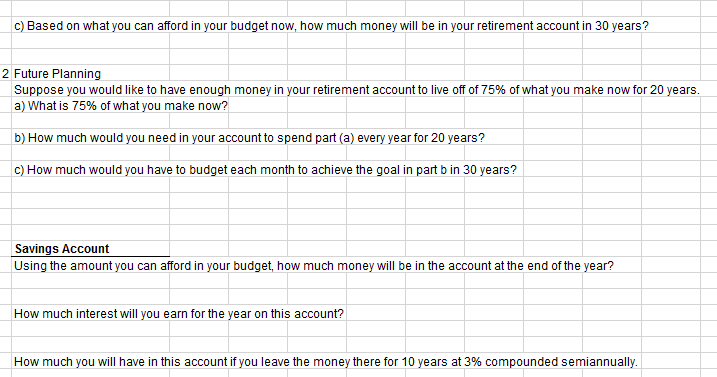

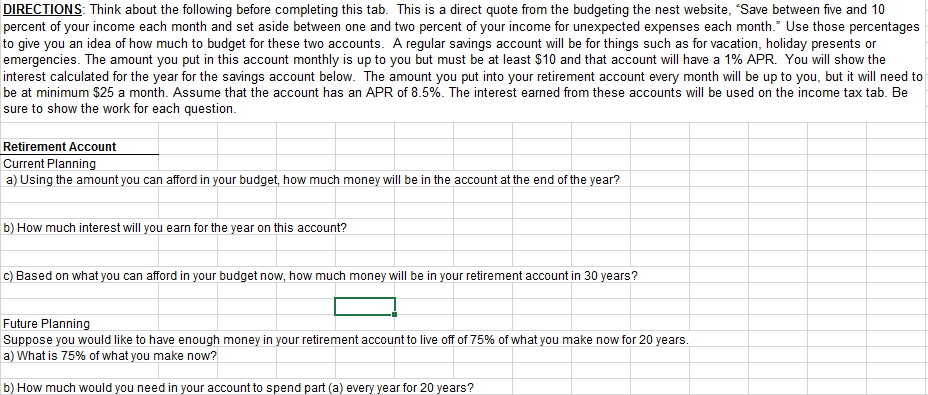

c) Based on what you can afford in your budget now, how much money will be in your retirement account in 30 years? 2 Future Planning Suppose you would like to have enough money in your retirement account to live off of75% of what you make now for 20 years a) What is 75% of what you make now? b) How much would you need in your account to spend part (a) every year for 20 years? c) How much would you have to budget each month to achieve the goal in part b in 30 years? Savings Account Using the amount you can afford in your budget, how much money will be in the account at the end of the year? How much interest will you earn for the year on this account? How much you will have in this account if you leave the money there for 10 years at 3% compounded semiannually. DIRECTIONS: Think about the following before completing this tab. This is a direct quote from the budgeting the nest website, "Save between ve and 10 percent of your income each month and set aside between one and two percent of your income for unexpected expenses each month. Use those percentages to give you an idea of how much to budget for these two accounts. A regular savings account will be for things such as for vacation, holiday presents or emergencies. The amount you put in this account monthly is up to you but must be at least S10 andthat account will have a 1% APR you will show the interest calculated for the year for the savings account below. The amount you put into your retirement account every month will be up to you, but it will need to be at minimum $25 a month. Assume that the account has an APR of 8.5%. The interest earned from these accounts will be used on the income tax tab Be sure to show the work for each question Retirement Account Current Planning a) Using the amount you can afford in your budget, how much money will be in the account at the end of the year? b) How much interest will you earn for the year on this account? c) Based on what you can afford in your budget now, how much money will be in your retirement account in 30 years? Future Planning Suppose you would like to have enough money in your retirement account to live off of 75% of what you make nowfor 20 years a) What is 75% of what you make now? b) How much would you need in your account to spend part (a) every year for 20 years? c) Based on what you can afford in your budget now, how much money will be in your retirement account in 30 years? 2 Future Planning Suppose you would like to have enough money in your retirement account to live off of75% of what you make now for 20 years a) What is 75% of what you make now? b) How much would you need in your account to spend part (a) every year for 20 years? c) How much would you have to budget each month to achieve the goal in part b in 30 years? Savings Account Using the amount you can afford in your budget, how much money will be in the account at the end of the year? How much interest will you earn for the year on this account? How much you will have in this account if you leave the money there for 10 years at 3% compounded semiannually. DIRECTIONS: Think about the following before completing this tab. This is a direct quote from the budgeting the nest website, "Save between ve and 10 percent of your income each month and set aside between one and two percent of your income for unexpected expenses each month. Use those percentages to give you an idea of how much to budget for these two accounts. A regular savings account will be for things such as for vacation, holiday presents or emergencies. The amount you put in this account monthly is up to you but must be at least S10 andthat account will have a 1% APR you will show the interest calculated for the year for the savings account below. The amount you put into your retirement account every month will be up to you, but it will need to be at minimum $25 a month. Assume that the account has an APR of 8.5%. The interest earned from these accounts will be used on the income tax tab Be sure to show the work for each question Retirement Account Current Planning a) Using the amount you can afford in your budget, how much money will be in the account at the end of the year? b) How much interest will you earn for the year on this account? c) Based on what you can afford in your budget now, how much money will be in your retirement account in 30 years? Future Planning Suppose you would like to have enough money in your retirement account to live off of 75% of what you make nowfor 20 years a) What is 75% of what you make now? b) How much would you need in your account to spend part (a) every year for 20 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts