Question: Can anyone do an example journal ledger for this problem? Johnson Incorporated is a job-order manufacturing company that uses a predetermined overhead rate based on

Can anyone do an example journal ledger for this problem?

Can anyone do an example journal ledger for this problem?

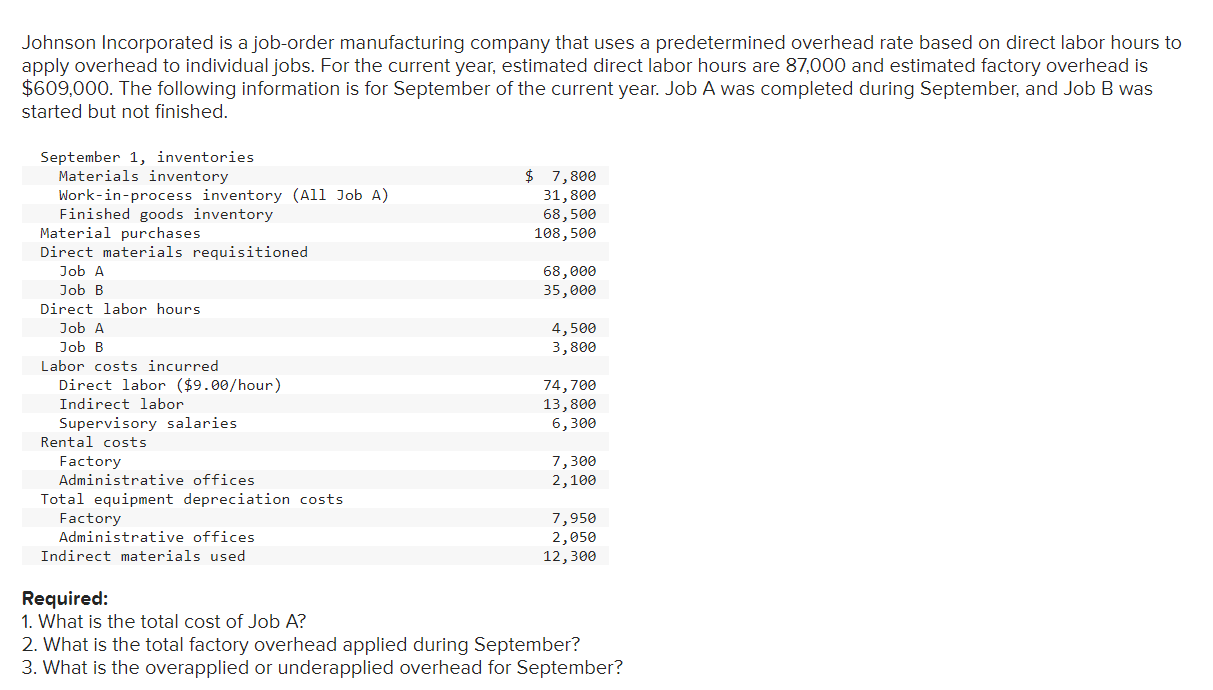

Johnson Incorporated is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 87,000 and estimated factory overhead is $609,000. The following information is for September of the current year. Job A was completed during September, and Job B was started but not finished. Required: 1. What is the total cost of Job A? 2. What is the total factory overhead applied during September? 3. What is the overapplied or underapplied overhead for September? Johnson Incorporated is a job-order manufacturing company that uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 87,000 and estimated factory overhead is $609,000. The following information is for September of the current year. Job A was completed during September, and Job B was started but not finished. Required: 1. What is the total cost of Job A? 2. What is the total factory overhead applied during September? 3. What is the overapplied or underapplied overhead for September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts