Question: Can anyone explain how these are incorrect when I used the same method to get Virtucon's data and it was correct? Problem 11-5A Calculate and

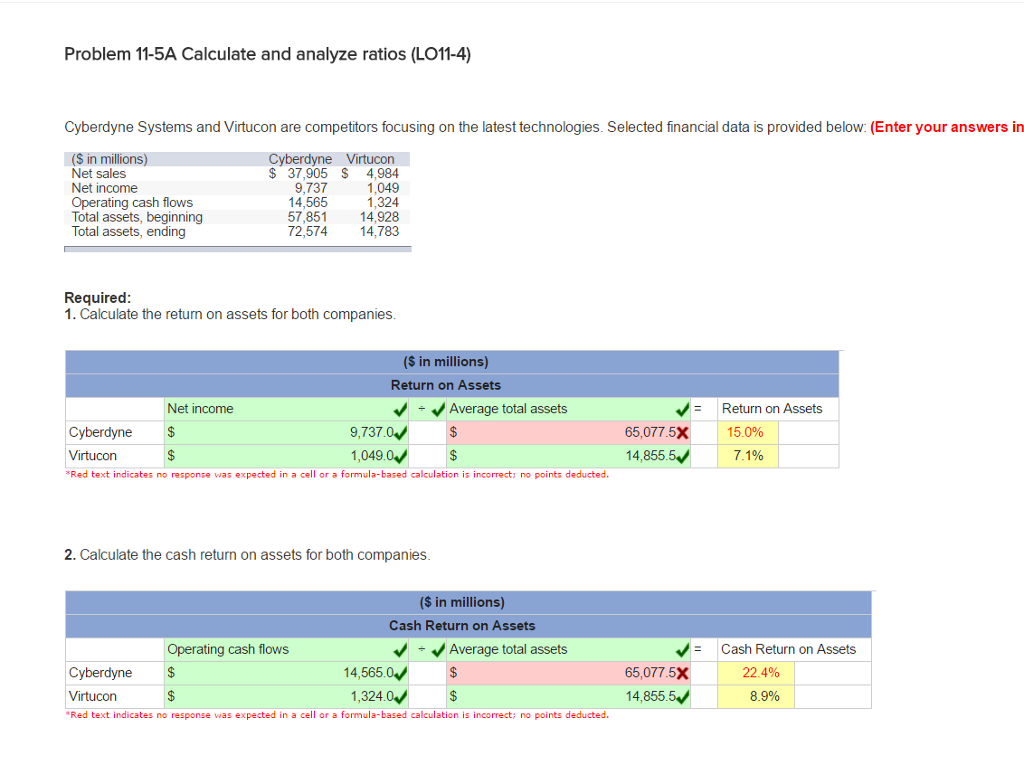

Can anyone explain how these are incorrect when I used the same method to get Virtucon's data and it was correct?

Problem 11-5A Calculate and analyze ratios (L011-4) Cyberdyne Systems and Virtucon are competitors focusing on the latest technologies. Selected financial data is provided below: (Enter your answers in Cyberdyne Virtucon in millions Net sales 37,905 4,984 9,737 1,049 Net income 1,324 Operating cash flows 14,565 Total assets, beginning 57,851 14,928 Total assets, ending 72,574 14,783 Required: 1. Calculate the return on assets for both companies in millions) Return on Assets VE Return on Assets V Average total assets Net income 65,077.5x 15.0% Cyberdyne 9,737.0 14,855.5V 71% 1,049.0 Virtucon d text indicates no response was expected in a cell or a formula-based calculation is incorrect: no points deducted. 2. Calculate the cash return on assets for both companies. in millions) Cash Return on Assets V V Average total assets Operating cash flows VE Cash Return on Assets 14,565 22.40% 65,077.5x Cyberdyne 14,855.5 1,324.0V Virtucon 8.9% Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts