Question: can anyone explain why we multiply 2000 by 5.30 and 2000 by 5.50 when we have 6000 of total units sold out? Aug 14 Exercise

can anyone explain why we multiply 2000 by 5.30 and 2000 by 5.50 when we have 6000 of total units sold out? Aug 14

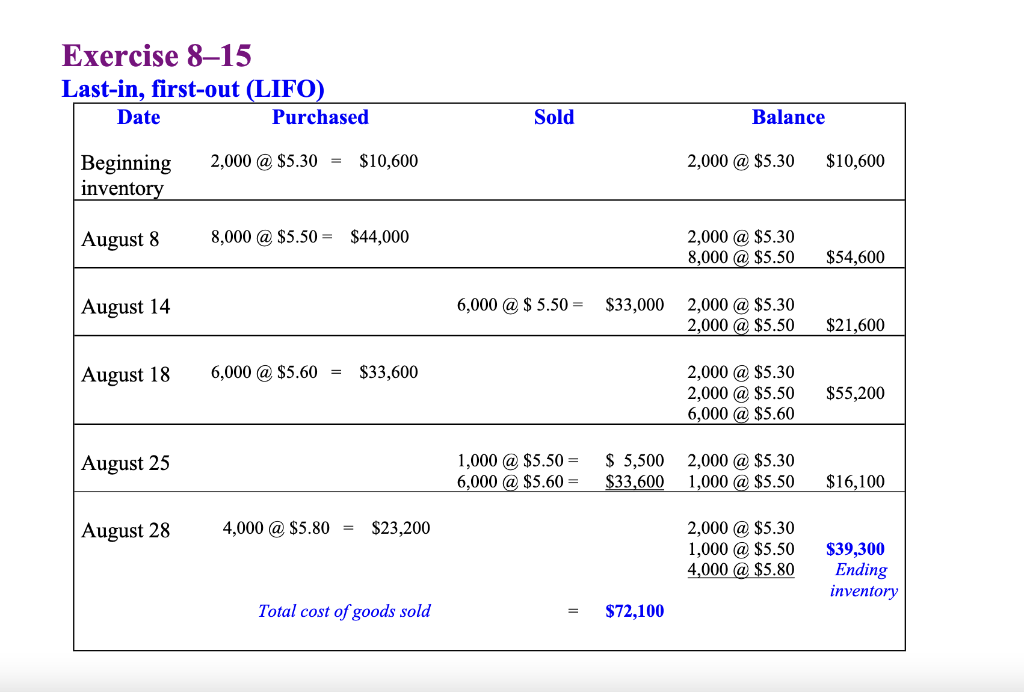

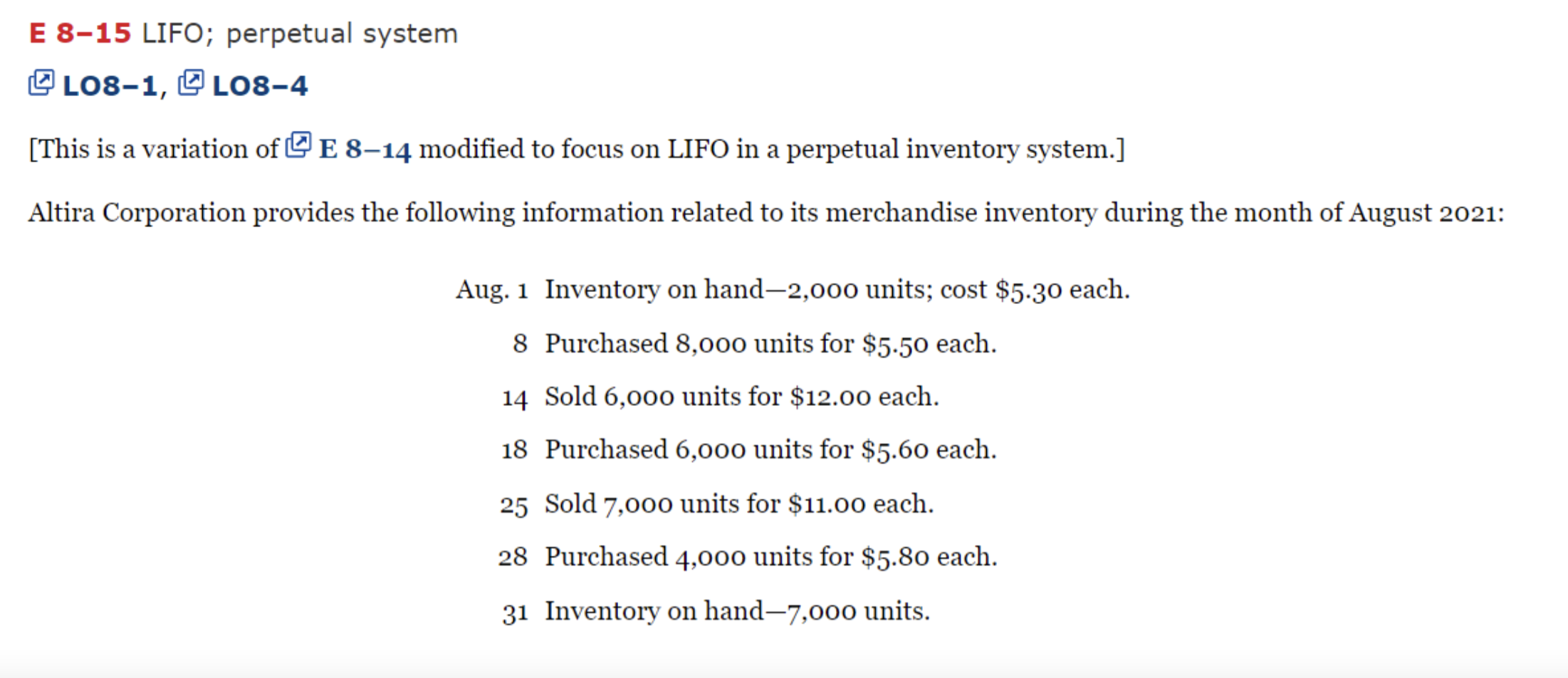

Exercise 815 Last-in, first-out (LIFO) Date Purchased Sold Balance 2,000 @ $5.30 = $10,600 2,000 @ $5.30 $10,600 Beginning inventory August 8 8,000 @ $5.50 = $44,000 2,000 @ $5.30 8,000 @ $5.50 $54,600 August 14 6,000 @ $ 5.50 = $33,000 2,000 @ $5.30 2,000 @ $5.50 $21,600 August 18 6,000 @ $5.60 = $33,600 2,000 @ $5.30 2,000 @ $5.50 6,000 @ $5.60 $55,200 August 25 1,000 @ $5.50 = 6,000 @ $5.60 = $ 5,500 $33,600 2,000 @ $5.30 1,000 @ $5.50 $16,100 August 28 4,000 @ $5.80 = $23,200 2,000 @ $5.30 1,000 @ $5.50 4,000 @ $5.80 $39,300 Ending inventory Total cost of goods sold $72,100 E 8-15 LIFO; perpetual system CL08-1, L08-4 [This is a variation of QE 8-14 modified to focus on LIFO in a perpetual inventory system.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug. 1 Inventory on hand2,000 units; cost $5.30 each. 8 Purchased 8,000 units for $5.50 each. 14 Sold 6,000 units for $12.00 each. 18 Purchased 6,000 units for $5.60 each. 25 Sold 7,000 units for $11.00 each. 28 Purchased 4,000 units for $5.80 each. 31 Inventory on hand-7,000 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts