Question: can anyone help me for the red box right answer thank you After closing the revenue and expense accounts, the profit for the year ended

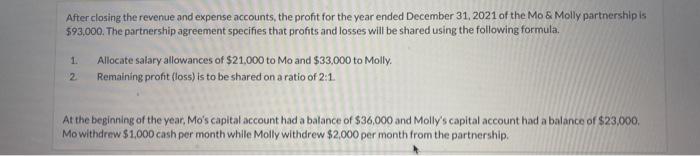

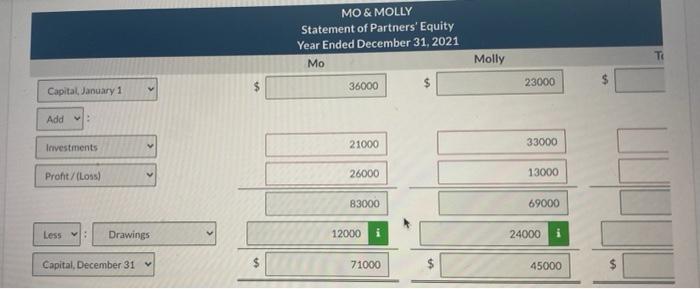

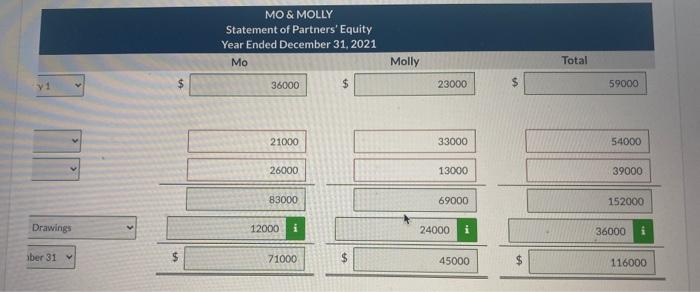

After closing the revenue and expense accounts, the profit for the year ended December 31, 2021 of the Mo & Molly partnership is $93,000. The partnership agreement specifies that profits and losses will be shared using the following formula. Allocate salary allowances of $21,000 to Mo and $33,000 to Molly. Remaining profit (loss) is to be shared on a ratio of 2:1 1. 2 At the beginning of the year, Mo's capital account had a balance of $36,000 and Molly's capital account had a balance of $23,000 Mo withdrew $1,000 cash per month while Molly withdrew $2,000 per month from the partnership MO & MOLLY Statement of Partners' Equity Year Ended December 31, 2021 Mo Molly TI 36000 23000 Capital, January 1 Add : Investments 21000 33000 Profit/(Loss 26000 13000 83000 69000 Less Drawings 12000 24000 Capital, December 31 $ 71000 45000 MO & MOLLY Statement of Partners' Equity Year Ended December 31, 2021 Mo Molly Total 36000 $ 23000 59000 21000 33000 54000 26000 13000 39000 83000 69000 152000 Drawings 12000 24000 i 36000 ber 31 $ 71000 $ 45000 $ 116000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts