Question: Can anyone help me out with these please !?! On March 1, 2020, Jagger Metal Corp. Issued 8.0% bonds dated January 1, 2020. The bonds

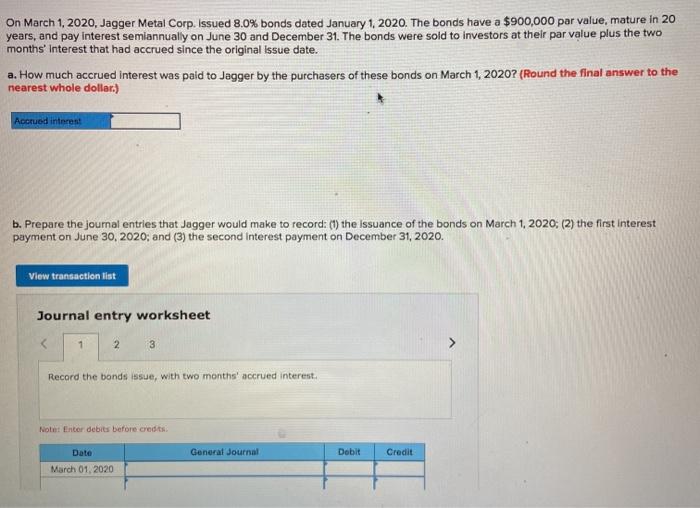

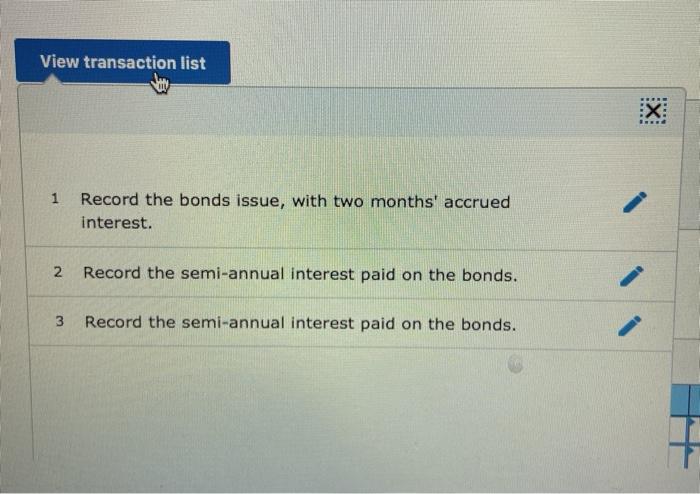

On March 1, 2020, Jagger Metal Corp. Issued 8.0% bonds dated January 1, 2020. The bonds have a $900,000 par value, mature in 20 years, and pay interest semiannually on June 30 and December 31. The bonds were sold to investors at their par value plus the two months' Interest that had accrued since the original Issue date. a. How much accrued interest was paid to Jagger by the purchasers of these bonds on March 1, 2020? (Round the final answer to the nearest whole dollar.) Accrued interest b. Prepare the journal entries that Jogger would make to record: (1) the issuance of the bonds on March 1, 2020; (2) the first interest payment on June 30, 2020; and (3) the second Interest payment on December 31, 2020. View transaction list Journal entry worksheet 1 2 3 Record the bonds issue, with two months' accrued interest Note Entor debits before credits General Journal Dobit Credit Date March 01, 2020 View transaction list X: 1 Record the bonds issue, with two months' accrued interest. 2 Record the semi-annual interest paid on the bonds. 3 Record the semi-annual interest paid on the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts