Question: Can anyone help me solve this problem (two long parts) ? Thank you!! Question 3 (25 marks) Part A (13 marks) Boeing is an American

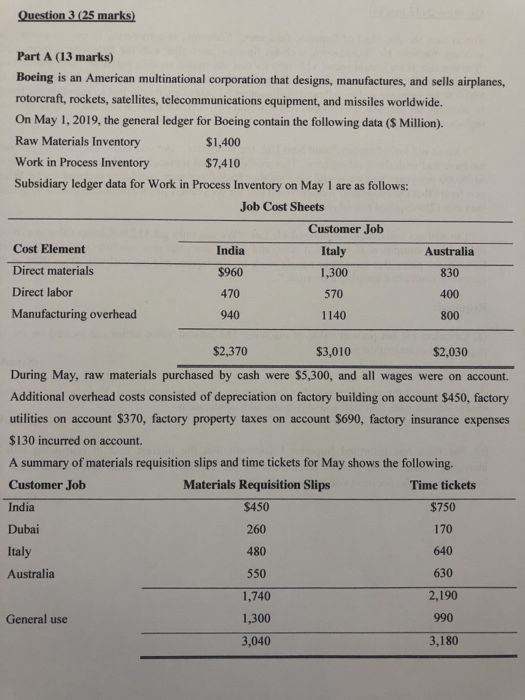

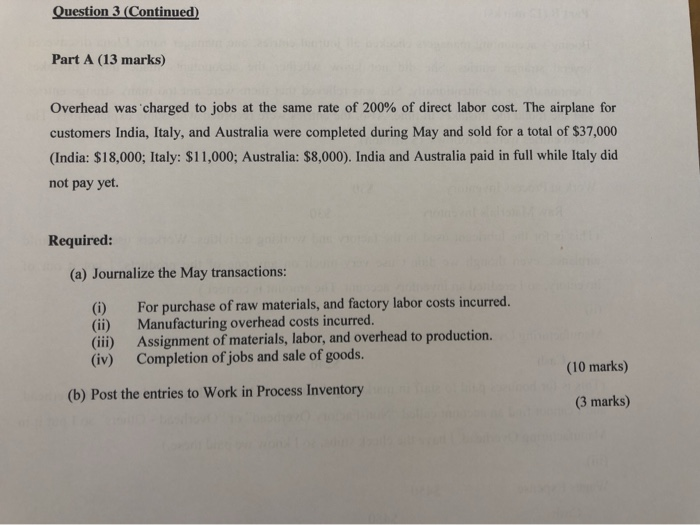

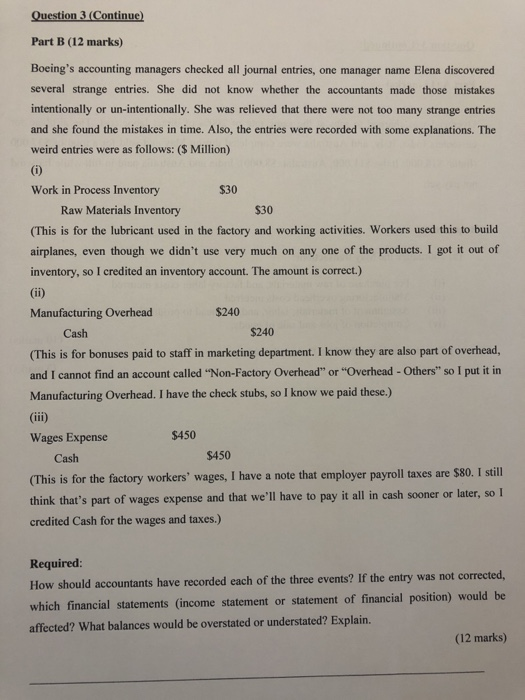

Question 3 (25 marks) Part A (13 marks) Boeing is an American multinational corporation that designs, manufactures, and sells airplanes, rotorcraft, rockets, satellites, telecommunications equipment, and missiles worldwide. On May 1, 2019, the general ledger for Boeing contain the following data (5 Million). Raw Materials Inventory $1,400 Work in Process Inventory $7,410 Subsidiary ledger data for Work in Process Inventory on May I are as follows: Job Cost Sheets Customer Job Cost Element India Italy Australia Direct materials $960 1,300 830 Direct labor 470 570 400 Manufacturing overhead 940 1140 800 $2,370 $3,010 $2,030 During May, raw materials purchased by cash were $5,300, and all wages were on account. Additional overhead costs consisted of depreciation on factory building on account $450, factory utilities on account $370, factory property taxes on account $690, factory insurance expenses $130 incurred on account. A summary of materials requisition slips and time tickets for May shows the following. Customer Job Materials Requisition Slips Time tickets India $450 $750 Dubai 260 170 Italy 480 640 Australia 550 630 1,740 2,190 General use 1,300 990 3,180 3,040 Question 3 (Continued) Part A (13 marks) Overhead was charged to jobs at the same rate of 200% of direct labor cost. The airplane for customers India, Italy, and Australia were completed during May and sold for a total of $37,000 (India: $18,000; Italy: $11,000; Australia: $8,000). India and Australia paid in full while Italy did not pay yet Required: (a) Journalize the May transactions: (i) (ii) (iii) (iv) For purchase of raw materials, and factory labor costs incurred. Manufacturing overhead costs incurred. Assignment of materials, labor, and overhead to production. Completion of jobs and sale of goods. (10 marks) (b) Post the entries to Work in Process Inventory (3 marks) Question 3 (Continue) Part B (12 marks) Boeing's accounting managers checked all journal entries, one manager name Elena discovered several strange entries. She did not know whether the accountants made those mistakes intentionally or un-intentionally. She was relieved that there were not too many strange entries and she found the mistakes in time. Also, the entries were recorded with some explanations. The weird entries were as follows: ($ Million) Work in Process Inventory $30 Raw Materials Inventory $30 (This is for the lubricant used in the factory and working activities. Workers used this to build airplanes, even though we didn't use very much on any one of the products. I got it out of inventory, so I credited an inventory account. The amount is correct.) (ii) Manufacturing Overhead $240 Cash $240 (This is for bonuses paid to staff in marketing department. I know they are also part of overhead, and I cannot find an account called "Non-Factory Overhead" or "Overhead - Others" so I put it in Manufacturing Overhead. I have the check stubs, so I know we paid these.) (iii) Wages Expense $450 Cash $450 (This is for the factory workers' wages, I have a note that employer payroll taxes are $80. I still think that's part of wages expense and that we'll have to pay it all in cash sooner or later, so I credited Cash for the wages and taxes.) Required: How should accountants have recorded each of the three events? If the entry was not corrected, which financial statements (income statement or statement of financial position) would be affected? What balances would be overstated or understated? Explain. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts