Question: can anyone help me solve this? Required information Problem 20.75 (LO 20-5, LO 20-6) (Algo) [The following information applies to the questions displayed below] Juan

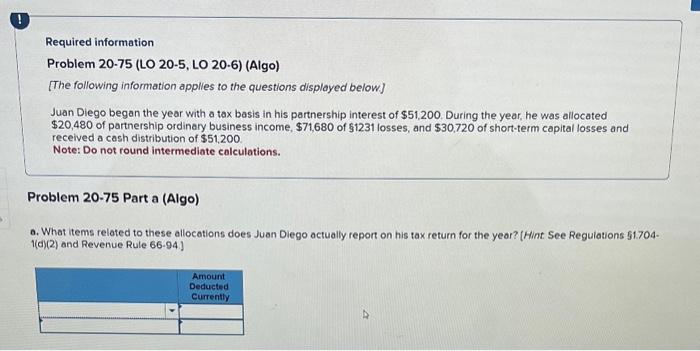

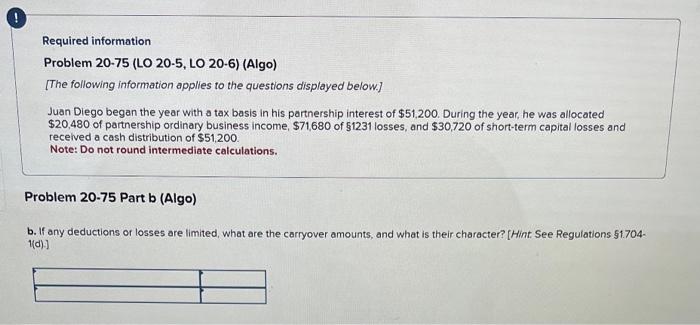

Required information Problem 20.75 (LO 20-5, LO 20-6) (Algo) [The following information applies to the questions displayed below] Juan Diego began the year with a tax basis in his partnership interest of $51,200. During the year, he was allocated $20,480 of parthership ordinary business income, $71,680 of $1231 losses, and $30,720 of short-term capital losses and received a cash distribution of $51,200. Note: Do not round intermediate calculations. Problem 20-75 Part a (Algo) a. What items related to these allocations does Juan Diego actually report on his tax return for the year? [Hint. See Regulations 51.704. 1(d)(2) and Revenue Rule 66.94] Required information Problem 20-75 (LO 20-5, LO 20-6) (Algo) [The following information applies to the questions displayed below.] Juan Diego began the year with a tax basis in his partnership interest of $51,200. During the year, he was allocated $20,480 of partnership ordinary business income, $71,680 of $1231 losses, and $30,720 of short-term capital losses and recelved a cash distribution of $51,200. Note: Do not round intermediate calculations. Problem 20-75 Part b (Algo) . If any deductions or losses are limited, what are the carryover amounts, and what is their character? [Hint: See Regulations 51.704 (d))]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts