Question: Can anyone help me solving this whole exercise? unless the Roic tree, is not necessarry! I just need to know how to calculate equity value

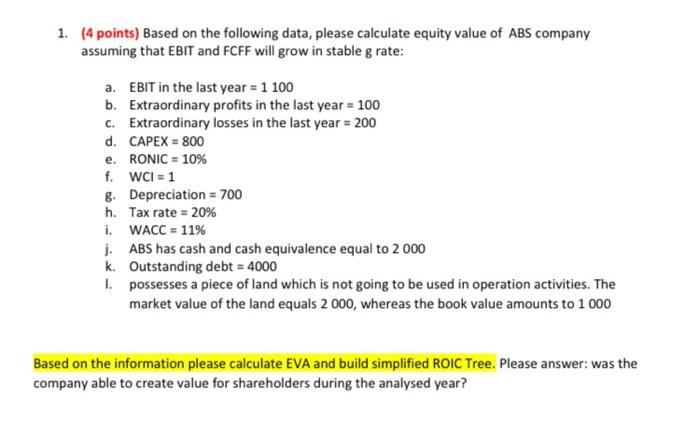

1. (4 points) Based on the following data, please calculate equity value of ABS company assuming that EBIT and FCFF will grow in stable g rate: a. EBIT in the last year = 1 100 b. Extraordinary profits in the last year = 100 C. Extraordinary losses in the last year = 200 d. CAPEX = 800 e. RONIC = 10% f. WCI = 1 g. Depreciation = 700 h. Tax rate = 20% i. WACC = 11% 1. ABS has cash and cash equivalence equal to 2 000 k. Outstanding debt = 4000 4 1. possesses a piece of land which is not going to be used in operation activities. The a market value of the land equals 2 000, whereas the book value amounts to 1 000 Based on the information please calculate EVA and build simplified ROIC Tree. Please answer: was the company able to create value for shareholders during the analysed year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts