Question: Can anyone help me to answer question c) d) e)? Thanks. Question ? (31 marks) cha 5. Queso adida) The accountant for Wilfred Trading Company

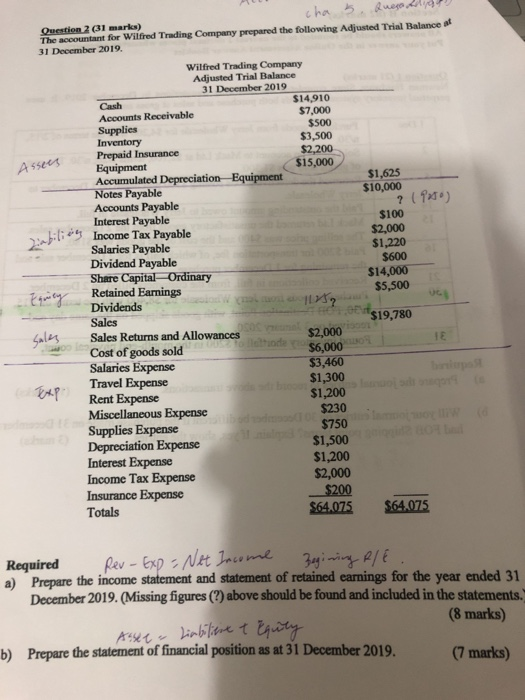

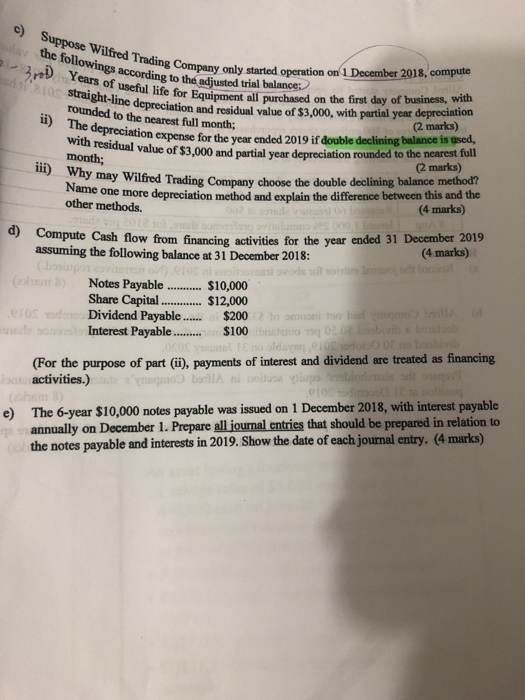

Question ? (31 marks) cha 5. Queso adida) The accountant for Wilfred Trading Company prepared the following Adjusted Trial Balance 31 December 2019. Asseus ) 1 Wilfred Trading Company Adjusted Trial Balance 31 December 2019 Cash $14,910 Accounts Receivable $7,000 $500 Supplies Inventory $3,500 Prepaid Insurance $2,200 Equipment $15,000 Accumulated Depreciation Equipment $1,625 Notes Payable $10,000 Accounts Payable 7 (9 Interest Payable $100 Income Tax Payable $2,000 Salaries Payable $1,220 Dividend Payable $600 Share Capital Ordinary $14,000 Retained Earnings $5,500 Dividends W 1752 $19,780 Sales $2.000 Sales Returns and Allowances O riode 2010 Cost of goods sold Salaries Expense $3,460 Travel Expense $1,300 Rent Expense $1,200 Miscellaneous Expense $230 Supplies Expense $750 Depreciation Expense $1,500 Interest Expense $1,200 Income Tax Expense $2,000 Insurance Expense Totals $64.075 $64.075 - Equity TE $200 Required Rev-Exp - Net Income Beginning P/E. a) Prepare the income statement and statement of retained earnings for the year ended 31 December 2019. (Missing figures (?) above should be found and included in the statements. (8 marks) Asset Liabilient t Equity b) Prepare the statement of financial position as at 31 December 2019. (7 marks) c) 3 Suppose Wilfred Trading Compe the followings according to the D Years of useful life for E To straight-line depreciation ar rounded to the nearest full month; The depreciation expe ss according to the adjusted trial balance & Company only started operation on 1 December 2018, compute hul life for Equipment all purchased on the first day of business, with e depreciation and residual value of $3,000, with partial year depreciation (2 marks) ciation expense for the year ended 2019 if double declining balance is used, value of $3,000 and partial year depreciation rounded to the nearest full (2 marks) y may Wilfred Trading Company choose the double declining balance method? ame one more depreciation method and explain the difference between this and the other methods. (4 marks) with residual value of $3,000 and partial ya month; Why may Wilfred w d) Compute Cash flow from financing activities for the vear ended 31 December 2012 Commute assuming the following balance at 31 December 2018: (4 marks) & Notes Payable ........... $10,000 Share Capital ............. $12,000 TO Tom Dividend Payable...... $2002 on the ser Interest Payable ......... $100 brusio 1 02.03 Lobivib s e b oldin OCD Obbi (For the purpose of part (i), payments of interest and dividend are treated as financing activities.) ho bol a poblatione OS e) The 6-year $10,000 notes payable was issued on 1 December 2018, with interest payable annually on December 1. Prepare all journal entries that should be prepared in relation to the notes payable and interests in 2019. Show the date of each journal entry. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts