Question: can anyone help me to solve this? Question 4 (Total 20 marks) ABC Education (ABC) issued $2,000,000 (Bond A), 10.5%, 10-year bonds on January 1,

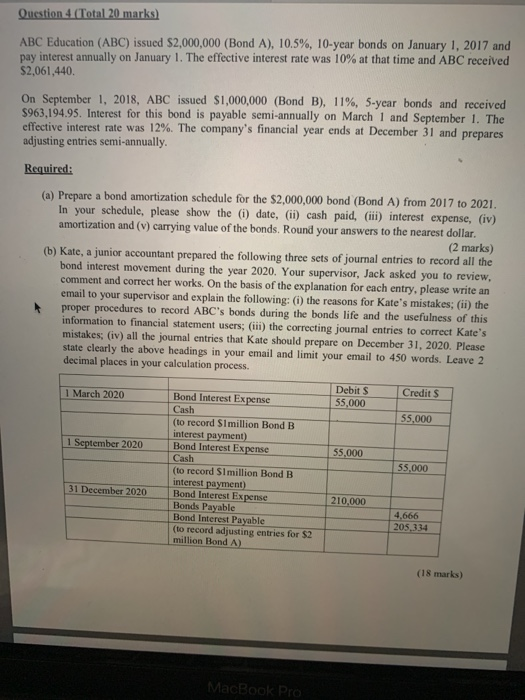

Question 4 (Total 20 marks) ABC Education (ABC) issued $2,000,000 (Bond A), 10.5%, 10-year bonds on January 1, 2017 and pay interest annually on January 1. The effective interest rate was 10% at that time and ABC received $2,061,440. On September 1, 2018, ABC issued $1,000,000 (Bond B), 11%, 5-year bonds and received $963,194.95. Interest for this bond is payable semi-annually on March 1 and September 1. The effective interest rate was 12%. The company's financial year ends at December 31 and prepares adjusting entries semi-annually. Required: (a) Prepare a bond amortization schedule for the $2,000,000 bond (Bond A) from 2017 to 2021. In your schedule, please show the (i) date, (ii) cash paid, (iii) interest expense, (iv) amortization and (V) carrying value of the bonds. Round your answers to the nearest dollar. (2 marks) (b) Kate, a junior accountant prepared the following three sets of journal entries to record all the bond interest movement during the year 2020. Your supervisor, Jack asked you to review. comment and correct her works. On the basis of the explanation for each entry, please write an email to your supervisor and explain the following: (i) the reasons for Kate's mistakes: (ii) the proper procedures to record ABC's bonds during the bonds life and the usefulness of this information to financial statement users; (iii) the correcting journal entries to correct Kate's mistakes; (iv) all the journal entries that Kate should prepare on December 31, 2020. Please state clearly the above headings in your email and limit your email to 450 words. Leave 2 decimal places in your calculation process. 1 March 2020 Debit S 55,000 Credits 55,000 1 September 2020 55.000 Bond Interest Expense Cash (to record Simillion Bond B interest payment) Bond Interest Expense Cash (to record Slmillion Bond B interest payment) Bond Interest Expense Bonds Payable Bond Interest Payable (to record adjusting entries for S2 million Bond A) 55,000 31 December 2020 210,000 14.666 205,334 (18 marks) MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts