Question: can anyone help me with Q d and e please? include work 5. Period 1: Firm A (Pre-merger) (20 points) Assumptions: Price = $4 per

can anyone help me with Q d and e please? include work

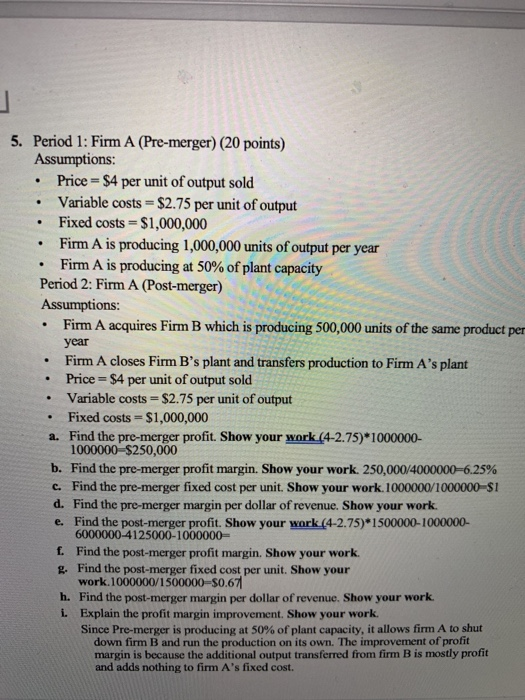

can anyone help me with Q d and e please? include work5. Period 1: Firm A (Pre-merger) (20 points) Assumptions: Price = $4 per unit of output sold Variable costs = $2.75 per unit of output Fixed costs = $1,000,000 Firm A is producing 1,000,000 units of output per year Firm A is producing at 50% of plant capacity Period 2: Firm A (Post-merger) Assumptions: Firm A acquires Firm B which is producing 500,000 units of the same product per year Firm A closes Firm B's plant and transfers production to Firm A's plant Price = $4 per unit of output sold Variable costs = $2.75 per unit of output Fixed costs = $1,000,000 a. Find the pre-merger profit. Show your work (4-2.75)*1000000- 1000000-$250,000 b. Find the pre-merger profit margin. Show your work. 250,000/4000000-6.25% c. Find the pre-merger fixed cost per unit. Show your work. 1000000/1000000-$1 d. Find the pre-merger margin per dollar of revenue. Show your work. e. Find the post-merger profit. Show your work (4-2.75)*1500000-1000000- 6000000-4125000-1000000= f. Find the post-merger profit margin. Show your work. g. Find the post-merger fixed cost per unit. Show your work.1000000/1500000-$0.67 h. Find the post-merger margin per dollar of revenue. Show your work. 1. Explain the profit margin improvement. Show your work. Since Pre-merger is producing at 50% of plant capacity, it allows firm A to shut down firm B and run the production on its own. The improvement of profit margin is because the additional output transferred from firm B is mostly profit and adds nothing to firm A's fixed cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts