Question: Can anyone help me with the solution? Question 1: Accounting for Corporate Income Taxes Star Company reported the following accounting income before income taxes for

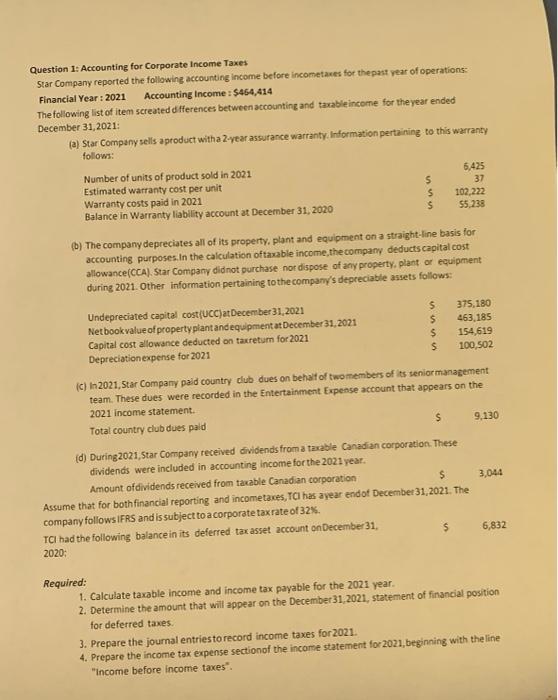

Question 1: Accounting for Corporate Income Taxes Star Company reported the following accounting income before income taxes for the past year of operations Financial Year: 2021 Accounting Income : 5454,414 The following list of item screated differences between accounting and taxable income for the year ended December 31, 2021 (a) Star Company sells a product with a 2-year assurance warranty Information pertaining to this warranty follows: Number of units of product sold in 2021 6,425 Estimated warranty cost per unit $ Warranty costs paid in 2021 $ 102 222 Balance in Warranty liability account at December 31, 2020 $ 55.238 37 b) The company depreciates all of its property, plant and equipment on a straight-line basis for accounting purposes. In the calculation of taxable income, the company deducts capital cost allowance(CCA), Star Company didnot purchase nor dispose of any property, plant or equipment during 2021. Other information pertaining to the company's depreciable assets follows: Undepreciated capital cost(UCC) at December 31,2021 $ 375,180 Netbook value of property plant and equipment at December 31, 2021 $ 463,185 Capital cost allowance deducted on taxreturn for 2021 $ 154,619 Depreciation expense for 2021 $ 100,502 ic) in 2021, Star Company paid country club dues on behalf of two members of its senior management team. These dues were recorded in the Entertainment Expense account that appears on the 2021 Income statement. Total country club dues pald $ 9,130 3,044 (d) During 2021, Star Company received dividends from a taxable Canadian corporation. These dividends were included in accounting income for the 2021 year. Amount of dividends received from taxable Canadian corporation $ Assume that for both financial reporting and income taxes, TC has a year endof December 31, 2021. The company follows IFRS and is subject to a corporate tax rate of 32%. TCI had the following balance in its deferred tax asset account on December 31, $ 2020: 6,832 Required: 1. Calculate taxable income and income tax payable for the 2021 year. 2. Determine the amount that will appear on the December 31,2021, statement of financial position for deferred taxes 3. Prepare the journal entries to record income taxes for 2021. 4. Prepare the income tax expense sectionof the income statement for 2021, beginning with the line "Income before income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts