Question: Can anyone help me with this? Learning Objectives 2, 3, 4, 5, 6, 7 Check Figure Schedule of accounts payable total 58,915.50 Problem 7-5B Objectivet

Can anyone help me with this?

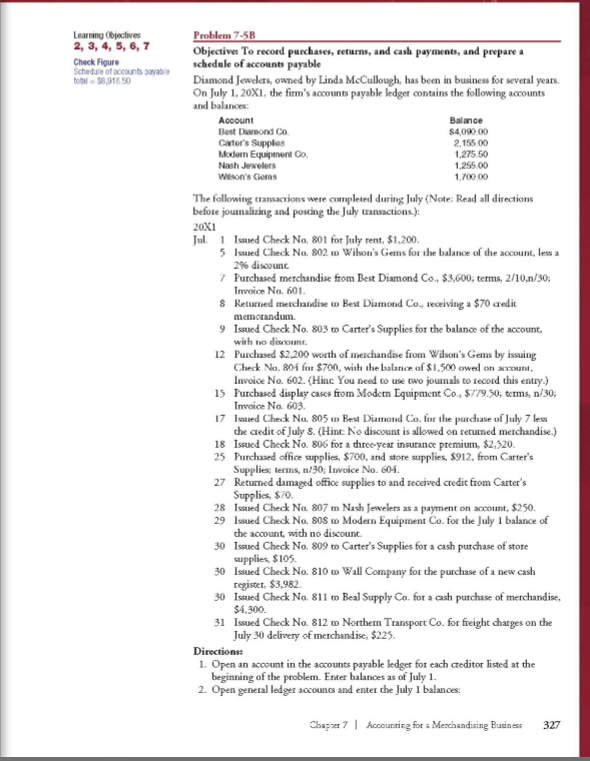

Learning Objectives 2, 3, 4, 5, 6, 7 Check Figure Schedule of accounts payable total 58,915.50 Problem 7-5B Objectivet To record purchases, returns, and cash payments, and prepare a schedule of accounts payable Diamond Jewees, owned by Linda McCullough, has been in business for several years. On July 1, 20X1, the firm's accounts payable ledger contains the following accounts and balances Account Balance Best Dumond Co $4,090.00 Castor's Supplies 2,15500 Modern Equipment Co 1.275,50 Nash Jewelers 1,255.00 Wilson's Corns 1.700.00 The following transactions were completed during July (Note: Read all directions before journalizing and posting the July transactions.) 20X1 Jul. 1 Issued Check No. 801 for July rent, $1,200. 5 lued Check No. 802 w Wilson's Gems for the balance of the account, lessa 2% discount 7 Purchased merchandise from Best Diamond Co. $3,600; terms, 2/10,n/30; Invoice No. 601 8 Returned merchandise w Best Dumond Co. receiving a $70 credit memorandum 9 Issued Check No. 803 to Carter's Supplies for the balance of the account, with no discount 12 Purchased $2.200 worth of merchandise from Wilson's Gems by issuing Check No. 801 $700, with the balance of $1.500 awes en mexan Invoice No. 602. (Hinc You need to use two journals to record this entry) 15 Purchased display cases from Modern Equipment Co., $779.30; terms, n/30; Invoice No. 603 17 lued Check No. 805 to Best Dumond Co. for the purchase of July 7 less che credit of July 8. (Hint: No discount is allowed on returned merchandise.) 18 Issued Check No. 806 for a three year insurance premium, $2.520. 25 Purchased office supplies, $700, and store supplies, $912, from Carter's Supplies terms, 1/30, Invoice No. 604. 27 Returned damaged office supplies to and received credit from Carter's Supplies, $70 28 Imed Check No. 807 in Nash Jewelers as a payment on account. $250. 29 Issued Check No. 80s to Modern Equipment Co. for the July 1 balance of che account with no discount 30 Issued Check No. 809 to Carter's Supplies for a cash purchase of store supplies $105 30 Issued Check No. 810 - Wall Company for the purchase of a new cash register. $3,982 30 Issued Check No 811 to Beal Supply Co. for a cash purchase of merchandise, $4,300. 31 Issued Check No. 812 to Northern Transport Co. for freight charges on the July 30 delivery of merchandise, $225. Directions 1. Open an account in the accounts payable ledger for each creditor listed at the beginning of the problem. Enter balances as of July 1. 2. Open general ledger 20counts and enter the July 1 balances: Chazza 7 Accounting for a Meschandising Business 327 Learning Objectives 2, 3, 4, 5, 6, 7 Check Figure Schedule of accounts payable total 58,915.50 Problem 7-5B Objectivet To record purchases, returns, and cash payments, and prepare a schedule of accounts payable Diamond Jewees, owned by Linda McCullough, has been in business for several years. On July 1, 20X1, the firm's accounts payable ledger contains the following accounts and balances Account Balance Best Dumond Co $4,090.00 Castor's Supplies 2,15500 Modern Equipment Co 1.275,50 Nash Jewelers 1,255.00 Wilson's Corns 1.700.00 The following transactions were completed during July (Note: Read all directions before journalizing and posting the July transactions.) 20X1 Jul. 1 Issued Check No. 801 for July rent, $1,200. 5 lued Check No. 802 w Wilson's Gems for the balance of the account, lessa 2% discount 7 Purchased merchandise from Best Diamond Co. $3,600; terms, 2/10,n/30; Invoice No. 601 8 Returned merchandise w Best Dumond Co. receiving a $70 credit memorandum 9 Issued Check No. 803 to Carter's Supplies for the balance of the account, with no discount 12 Purchased $2.200 worth of merchandise from Wilson's Gems by issuing Check No. 801 $700, with the balance of $1.500 awes en mexan Invoice No. 602. (Hinc You need to use two journals to record this entry) 15 Purchased display cases from Modern Equipment Co., $779.30; terms, n/30; Invoice No. 603 17 lued Check No. 805 to Best Dumond Co. for the purchase of July 7 less che credit of July 8. (Hint: No discount is allowed on returned merchandise.) 18 Issued Check No. 806 for a three year insurance premium, $2.520. 25 Purchased office supplies, $700, and store supplies, $912, from Carter's Supplies terms, 1/30, Invoice No. 604. 27 Returned damaged office supplies to and received credit from Carter's Supplies, $70 28 Imed Check No. 807 in Nash Jewelers as a payment on account. $250. 29 Issued Check No. 80s to Modern Equipment Co. for the July 1 balance of che account with no discount 30 Issued Check No. 809 to Carter's Supplies for a cash purchase of store supplies $105 30 Issued Check No. 810 - Wall Company for the purchase of a new cash register. $3,982 30 Issued Check No 811 to Beal Supply Co. for a cash purchase of merchandise, $4,300. 31 Issued Check No. 812 to Northern Transport Co. for freight charges on the July 30 delivery of merchandise, $225. Directions 1. Open an account in the accounts payable ledger for each creditor listed at the beginning of the problem. Enter balances as of July 1. 2. Open general ledger 20counts and enter the July 1 balances: Chazza 7 Accounting for a Meschandising Business 327

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts